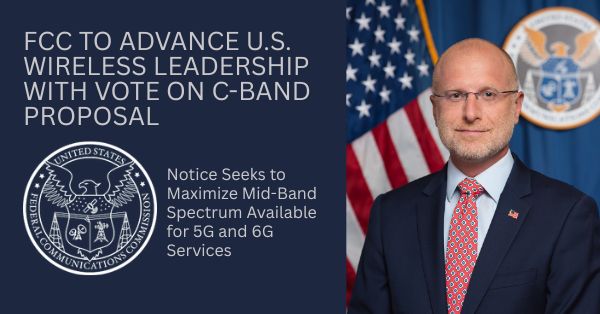

FCC proposes upper C-Band auctions to expand 5G and enable 6G

The FCC is circulating a proposal to reconfigure and auction a significant slice of upper C-Band spectrum, with a vote slated for November and a public comment period to shape the details.

Auction scope, MHz targets, and 2027 timeline

The draft notice of proposed rulemaking (NPRM) seeks input on auctioning up to 180 MHz of upper C-Band in the contiguous United States for licensed mobile broadband, with a floor of at least 100 MHz mandated by Congress for auction by July 2027. The plan builds on the 2020 lower C-Band (3.7–3.98 GHz) auction that catalyzed nationwide 5G and aims to extend that momentum into the remaining portion of the 3.7–4.2 GHz band.

NPRM comment topics: spectrum amounts, coexistence, and rules

The FCC is asking industry to weigh in on how much spectrum can be repurposed, transition strategies for incumbent satellite uses, coexistence protections for adjacent aviation radio altimeters, auction mechanics, license sizing and geography, technical service rules, and timelines. Commissioner Brendan Carr, who is circulating the NPRM, frames the objective as maximizing mid-band capacity for 5G and setting the stage for 6G, while maintaining aviation safety.

Why upper C-Band mid-band spectrum matters now

Mid-band spectrum remains the most valuable real estate for capacity, coverage, and economics as operators scale 5G Advanced and prepare for early 6G.

Mid-band advantages for 5G Advanced and early 6G

Upper C-Band sits squarely in the global 3GPP n77 ecosystem, where Massive MIMO and advanced TDD deliver strong spectral efficiency at citywide ranges. More contiguous bandwidth directly translates into higher downlink throughput, better uplink with features like UL MIMO, and lower cost-per-bit—key for enterprise services, FWA, and emerging XR workloads. For 6G, mid-band will complement FR3 (7–15 GHz) as a coverage layer; securing more n77 capacity now gives operators a future-proof runway.

Device, chipset, and RAN readiness for n77

The good news: most contemporary chipsets and many handsets support wide n77 implementations, easing device availability risks. That means a large share of the installed base could tap new upper C-Band holdings faster, with network-side software and RAN upgrades, once technical rules are settled. Radio vendors already ship 64T64R and 32T32R radios that span broader n77 ranges, minimizing hardware fragmentation.

Technical and regulatory hurdles for upper C-Band auctions

The path to auction requires credible plans that protect aviation, clear incumbents, and structure licenses to stimulate investment without stranding capital.

Protecting aviation: radio altimeter coexistence and guard bands

Radio altimeters operate above C-Band in the 4.2–4.4 GHz range. The FCC will explore how much of the “upper” portion of 3.7–4.2 GHz can be repurposed while maintaining an adequate guard, accounting for altimeter upgrades and filtering improvements under evolving aviation standards. Expect discussion of out-of-band emissions masks, power and antenna tilt limits near airports, and targeted mitigations akin to the initial lower C-Band deployment playbook.

Satellite FSS clearing and relocation framework

Fixed-satellite service (FSS) earth stations remain in the upper C-Band. As with the 2020 auction, the FCC will need a defensible relocation framework, funding mechanisms, and milestones to transition FSS traffic to remaining spectrum, fiber, or alternate bands. Satellite operators will push for realistic timelines and reimbursement; mobile operators will push for acceleration incentives to bring spectrum to market ahead of the 2027 deadline.

Auction design, license sizing, and geographic options

Stakeholders should expect a familiar Part 27 flexible-use regime with performance metrics and interference coordination in TDD. Key design choices include block size (for example, 20 MHz), license geography (PEA vs. EA), assignment-phase rules, and secondary market flexibility. There is also room for proposals on localized licensing or streamlined leasing to spur private 5G, neutral host, and utility deployments without undermining nationwide coverage economics.

Market impact and beneficiaries of upper C-Band spectrum

Additional upper C-Band will redistribute competitive advantage, influence capex roadmaps, and ripple through vendor and enterprise strategies.

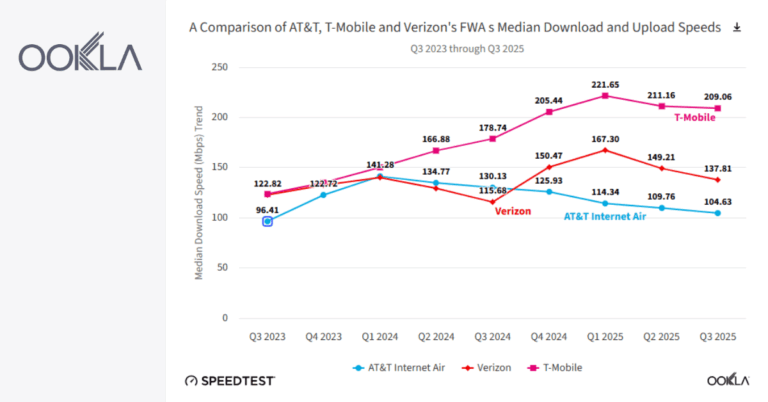

Strategies for mobile operators and cable entrants

Incumbent nationwide operators that anchored mid-band 5G in C-Band will want contiguous extensions to simplify carrier aggregation and scheduler efficiency. Additional mid-band helps offset dense mmWave reliance, strengthens FWA economics, and supports premium tiers with 5G Advanced features. Cable operators with wireless ambitions and regional carriers may also bid to bolster localized capacity in high-traffic markets. Valuation will hinge on guard-band assumptions, airport constraints, and clearing speed.

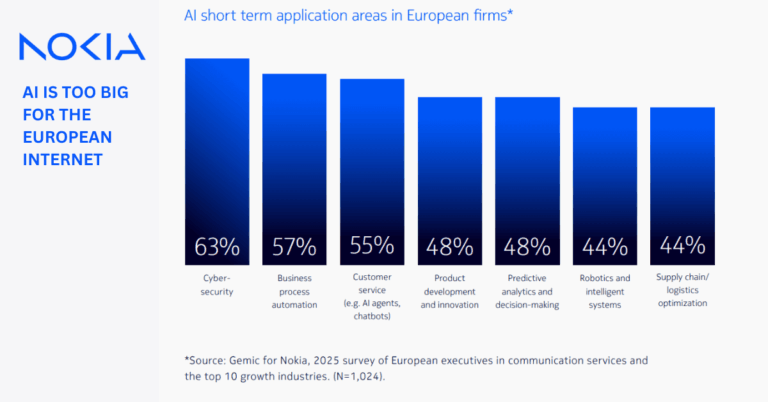

Enterprise, utilities, and vertical use cases

Licensed mid-band enables deterministic SLAs for factories, logistics hubs, venues, and campuses that have outgrown CBRS GAA or need macro-grade mobility. Enterprises should lobby for pragmatic leasing policies and partitions/disaggregations to enable local deployments, and for coordinated frameworks with CBRS to reduce interference complexity in dense metros. Utilities and transportation providers may seek carve-outs near critical infrastructure.

Vendor ecosystem, chipsets, and testing implications

RAN vendors can grow average selling prices with wideband n77 radios and software for advanced TDD coordination, UL enhancements, and AI-driven beamforming. Device and RF front-end suppliers will emphasize filter linearity and coexistence performance near the aviation band. Satellite vendors will shape relocation architectures, while testing and measurement vendors will see demand for certification against tighter emissions limits.

Next steps, timelines, and actions to prepare

The next six to twelve months will set the technical guardrails, auction shape, and industry timeline—planning now reduces execution risk later.

Near-term milestones and regulatory watchpoints

Track the FCC’s November vote, initial comment and reply deadlines, and any parallel FAA/RTCA updates on altimeter standards that could influence guard-band decisions. Watch for the FCC’s proposed service rules, auction format, and any acceleration incentives for satellite clearing. Industry signals from CTIA, major operators, and aviation groups will reveal where compromise is forming.

Action items for operators and enterprises

– Run spectrum valuation and scenario models for 100–180 MHz outcomes by market, factoring airport mitigations and clearing dates.

– Audit device and RAN portfolios for wide n77 readiness; plan phased software and hardware upgrades to light up additional bandwidth quickly.

– Engage in the docket to advocate on coexistence masks, license sizing, and secondary market flexibility that support both macro scalability and enterprise use.

– For enterprises, define priority sites and partners, quantify SLA and mobility needs beyond CBRS, and prepare to leverage leasing or local licenses if they materialize.

The FCC’s upper C-Band push is a pragmatic way to add national mid-band capacity in time to support 5G Advanced growth and early 6G experimentation; the winners will be those who shape the rules now and are ready to deploy on day one.