Q3 Results: organic growth, higher 2025 guidance, capital returns

Deutsche Telekom delivered a solid quarter powered by the U.S., accelerating fiber in Germany, and a tighter portfolio, prompting another guidance uplift and a planned record dividend.

Key metrics and 2025 outlook

Group revenue reached about €28.9 billion, up 3.3% on an organic basis, with service revenue and adjusted EBITDA AL growing despite currency pressure from a weaker U.S. dollar; adjusted EBITDA AL was roughly €11.1 billion on an organic basis, and full-year 2025 EBITDA AL guidance rose to around €45.3 billion alongside a stronger free cash flow after leases outlook near €20.1 billion.

Adjusted net profit increased to approximately €2.7 billion (+14% year-on-year), while reported net profit was €2.4 billion (-18% year-on-year) due to lapping prior-year one-offs in financial activities—an accounting effect rather than a signal of operating weakness.

FX impact and record dividend plan

FX headwinds weighed on reported growth, but operational momentum continues to outpace currency volatility, enabling Deutsche Telekom to flag a record-high dividend for the current financial year and reinforce its credibility on capital returns.

United States: T-Mobile US drives subscriber and service revenue growth

The U.S. unit again set the pace with industry-leading postpaid momentum and double-digit service revenue growth.

Postpaid momentum and double-digit service revenue

T-Mobile US delivered record postpaid net adds of about 2.3 million, including 1.0 million postpaid phone customers, with service revenue up roughly 9% year-on-year and adjusted EBITDA AL growing in the mid‑single digits.

Management raised full-year postpaid net add guidance to 7.2–7.4 million, up from earlier expectations, highlighting sustained demand for premium 5G plans and the stickiness created by national coverage, capacity, and simple unlimited offers.

UScellular consolidation and network scale advantages

The consolidation of UScellular from early August modestly lifts the U.S. trendline and underscores the strategic value of scale—more sites, spectrum depth, and rural reach—supporting continued service revenue expansion and better network unit economics.

For enterprise buyers, the U.S. trajectory signals a stable 5G roadmap with capacity to support mobility, private wireless extensions, and fixed access alternatives where applicable.

Germany: FTTH rollout accelerates; mobile growth resilient

Domestic performance mixed: revenue edged down, EBITDA held steady, and fiber accelerated to a new high-water mark.

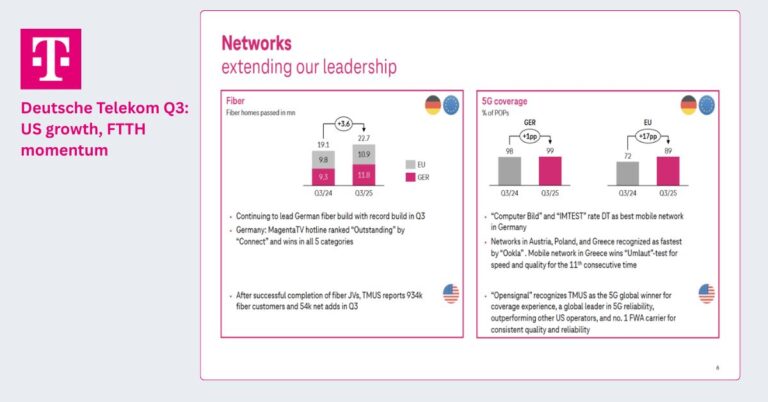

Record FTTH adds and expanding passings

Deutsche Telekom added 155,000 net FTTH customers in Q3—its strongest pure-fiber quarter to date—bringing fiber passings to 11.8 million households and proving that demand for higher-throughput, low-latency access is moving from early adopters to the mainstream.

Broadband market flat; migration from copper to fiber

Germany’s overall broadband market is flat, and the company shed around 25,000 total broadband lines even as it grew pure-fiber subscribers, a typical transition pattern as legacy copper and cable churn offsets FTTH gains during migration phases.

Capex focus: fiber acceleration and tax incentives

Mobile service revenue grew about 1.8% organically, with branded contract adds of roughly 314,000 supported by unlimited plans; domestically, revenue slipped ~1.8% while adjusted EBITDA AL ticked up to ~€2.7 billion, and management plans to reinvest tax benefits from accelerated depreciation into speeding the fiber rollout.

Europe and T-Systems: steady growth and portfolio simplification

Outside Germany and the U.S., Europe delivered healthy organic growth and T-Systems improved profitability, while the exit from Romania streamlines focus.

Europe segment: organic revenue and EBITDA growth

The Europe segment posted organic adjusted EBITDA AL growth of about 4.6% to €1.2 billion on revenue of €3.2 billion (+2.2% organic), consistent with medium-term guidance set at the 2024 Capital Markets Day.

Romania exit completes portfolio rationalization

The sale of the mobile business in Romania closed on October 1, 2025; combined with the earlier fixed-line divestment, the company has now exited the market, simplifying the footprint and concentrating capital where returns are higher.

T-Systems: improving cloud profitability and orders

T-Systems continued its earnings turnaround, with adjusted EBITDA AL near €127 million (+23% organic) on ~€1.0 billion revenue (+3% organic), driven by improving cloud profitability; order intake fell year-on-year this quarter but improved on a trailing 12‑month basis.

Strategy: fiber network and AI at the core

DT is aligning heavy fiber investment with an AI-first agenda to underpin industrial transformation and internal productivity at scale.

Munich industrial AI cloud with Nvidia and Brookfield

Plans are advancing for a large-scale AI data center in Munich, developed with Nvidia and Brookfield, positioned as Europe’s first industrial AI cloud for manufacturers, designed for high-density compute, powered by 100% renewable energy, and slated to break ground in 2026.

AI embedded in care, sales, and network operations

AI is being embedded across customer care, knowledge management, sales, and network operations, setting up cost-to-serve reductions, faster problem resolution, and smarter network planning—advantages that compound as data sets and model tuning improve.

Network prerequisites: FTTH, edge computing, and 5G SA

For industrial AI, robotics, and computer vision, the combination of ubiquitous FTTH, 5G Standalone, and edge compute will be essential to meet latency and throughput targets; DT’s build-out creates an access and transport fabric that can host AI inference closer to users and factories.

What’s next: actions and signals to monitor

Operators, enterprises, and investors should calibrate plans to the interplay of fiber adoption, 5G capacity, and AI workload placement.

Guidance for operators

Lean into fiber migration economics (ARPU uplift, lower opex, lower fault rates) while using unlimited mobile tiers to defend share; accelerate 5G SA and edge nodes to monetize low-latency use cases and prepare for AI-assisted assurance and autonomous operations.

Guidance for enterprise buyers

Evaluate DT and T-Mobile US as primary partners for multi-site connectivity plus edge/AI pilots; prioritize FTTH access where available for deterministic performance, and align data governance with EU requirements when considering the Munich industrial AI cloud.

Key risks, FX, and execution milestones

Monitor FX volatility on reported metrics, German broadband substitution dynamics during copper-to-fiber migration, and U.S. competitive intensity; keep an eye on DT’s dividend policy, UScellular integration synergies, and the execution milestones for the Munich AI facility as leading indicators.