CCC defines the BLE-UWB-NFC wireless stack for connected vehicles

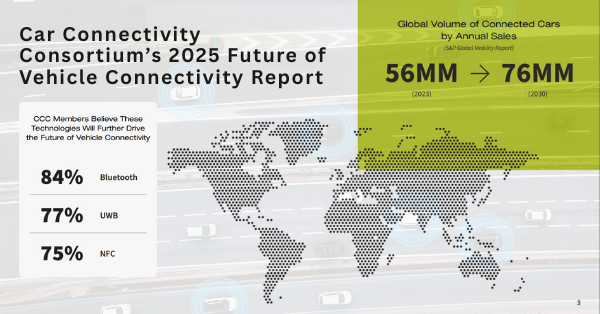

New data from the Car Connectivity Consortium’s 2025 Future of Vehicle Connectivity Report signals how OEMs, suppliers, and mobile platforms will prioritize standards, security, and interoperability to scale the next phase of software-defined vehicles.

Software-defined vehicle growth depends on standards

Deloitte projects the software-defined vehicle opportunity to reach up to $600 billion by 2030, and the CCC’s findings underscore that scale will hinge on common, device-to-vehicle standards that cut integration cost and risk. With more than 300 member companies, the CCC spans leading automakers and Tier 1s alongside the world’s largest device and platform providers—its board includes Apple, BMW, CARIAD, DENSO, Ford, General Motors, Google, Honda, Hyundai, Mercedes-Benz, NXP, Panasonic Automotive Systems, Samsung, Thales, and Xiaomi—putting the group at the center of cross-ecosystem alignment and certification.

Why CCC’s 2025 connectivity report matters now

The market is past pilots: executives are moving budget into customer experience and fleet productivity where ROI is visible within a year, but only if solutions are secure, easy to use, and proven to interoperate across brands, devices, and regions. The CCC’s data provides a directional roadmap for where to invest in the in-vehicle wireless stack and the edge-to-cloud controls that make those experiences trustworthy.

Connected-vehicle priorities for 2025

The survey highlights clear near-term priorities across consumer and fleet domains, with security and simplicity now table stakes.

Security, privacy, and simplicity as table stakes

Sixty percent of respondents ranked privacy/security and ease of use as the top benefits of connected vehicles. That framing matters: consumer-grade simplicity must coexist with enterprise-grade security, and buyers will punish experiences that create friction or raise data-risk concerns. For OEMs and suppliers, this translates into architectural choices that minimize attack surface, preserve user control over data, and eliminate UX variability across phone models and operating systems.

Fleet use cases delivering measurable ROI

Operational value is leading the curve. Seventy-two percent cited GPS fleet tracking as delivering strong value, and 62% pointed to fleet management—spanning rentals and rideshares—as a key growth area. More than half of fleet operators reported positive ROI within a year from predictive analytics and asset tracking. This is a signal to product teams: prioritize features that compress time-to-value (e.g., automated access, secure handoffs, utilization analytics) and can be sold as software and services, not just hardware options.

The in-vehicle wireless stack that wins

The industry is converging on a layered approach that uses complementary short-range radios for secure, seamless device-to-vehicle experiences.

Bluetooth Low Energy for discovery, presence, and control

Eighty-four percent of members identified Bluetooth Low Energy (BLE) as critical. BLE is the baseline for broad compatibility and power-efficient discovery, enabling core functions like presence detection, notifications, and control channels across virtually every smartphone. For engineering teams, BLE’s ubiquity makes it the connective tissue for multi-mode experiences and helps reduce interoperability test matrices.

Ultra-Wideband for precise ranging and hardened security

Seventy-seven percent called out Ultra-Wideband (UWB) as essential. UWB’s fine-ranging and distance-bounding capabilities enable robust, relay-resistant vehicle access and context-aware features (for example, determining whether the phone is inside or outside the cabin). When paired with BLE for discovery, UWB delivers both a premium experience and a hardened security posture for digital keys and access automation.

NFC for tap-to-unlock, provisioning, and service fallback

Seventy-five percent cited Near-Field Communication (NFC), which provides a predictable backup path for tap-to-unlock and provisioning scenarios, including unpowered devices. NFC also supports service and recovery workflows—an important operational safeguard for fleets and rental models where phone battery, RF conditions, and user familiarity vary.

Interoperability through CCC specifications and certification

With 82% of respondents prioritizing connected-car experiences and vehicle access, the message is clear: BLE, UWB, and NFC must be delivered as a coherent, certified stack that works across automakers and device ecosystems. This is precisely the role of the CCC’s global specifications and certification program—ensuring implementations behave consistently, meet security expectations, and ship at scale without brand-by-brand exceptions.

Strategy for OEMs, suppliers, and platform partners

The report’s signals map directly to product, security, and go-to-market decisions over the next 12–24 months.

Design for cross-ecosystem reliability and certification

Mixed device fleets are the norm, not the edge case. Build against CCC specifications for digital vehicle access and align early with certification roadmaps to avoid post-launch rework. Plan for rigorous cross-OS validation (Apple and Android) and RF performance testing in diverse environments (urban canyons, garages, dense rental lots) to de-risk field variability.

Engineer chip-to-cloud security and key lifecycle

Security outcomes depend on the whole chain: secure elements and UWB/BLE silicon (from vendors like NXP and others), protected key storage, robust pairing and distance-bounding, tamper-resistant identity, and cloud-side credential lifecycle (issuance, rotation, revocation). Engage security providers early to embed hardware anchors of trust, and instrument telemetry so SOC teams can detect anomalies without compromising privacy.

Monetize fleets with fast time-to-value solutions

Fleet operators are signaling where budgets will land in 2025: automated access, remote handoffs, geofenced operations, predictive maintenance, and loss prevention. Package features as tiered software plans, link them to measurable KPIs (turn time, utilization, theft reduction), and ensure admin controls and auditability meet rental and rideshare compliance needs.

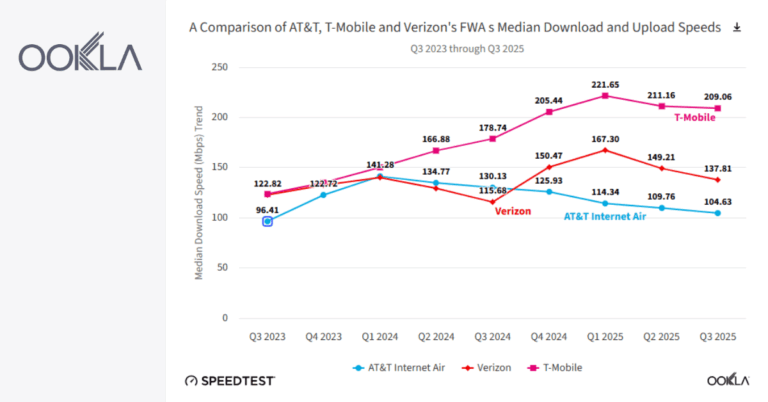

Align vehicle and network roadmaps (TCU, eSIM, 5G)

Short-range access radios will coexist with cellular connectivity for telematics and analytics. Coordinate TCU, eSIM, and cloud pipelines so access events, diagnostics, and location data flow into analytics and support systems with low latency and strong privacy controls. For markets rolling out 5G Advanced and evolving edge compute, plan how those capabilities compress detection-to-decision cycles for fleet and safety use cases.

Next steps to scale connected-vehicle programs

Organizations can turn the report’s signals into execution by prioritizing standards, security, and measurable business outcomes.

Anchor on CCC specs and certification early

Adopt the BLE-UWB-NFC triad as the default for digital access and related experiences, implement according to CCC specifications, and schedule certification entry early in the development cycle. Treat certification not as a checkbox but as the way to guarantee cross-brand reliability.

Harden identity, credentials, and key lifecycle

Define policies for credential issuance, sharing, and revocation; implement secure storage and distance-bounding; and exercise recovery paths (NFC tap, mechanical fallback) for real-world edge cases. Ensure privacy-by-design so user and fleet data handling meets regional regulations.

Productize fleet value with rapid pilots and KPIs

Stand up rapid pilots with rental, rideshare, or corporate fleet partners to prove one-year ROI on access automation, asset tracking, and predictive maintenance. Use those results to refine packaging and pricing, and to prioritize platform integrations that streamline operations.

Build RF and UX test discipline across devices and regions

Create integrated test suites for BLE, UWB, and NFC across devices, trims, and regions; include coexistence with Wi‑Fi and cellular; and validate that UX flows remain intuitive across failure modes. This is how “security and simplicity” become reality—not just aspirations.

The connected-vehicle playbook is consolidating: a standards-based, multi-radio access stack; a security spine from silicon to cloud; and a services roadmap that proves ROI quickly, especially in fleets. The companies that operationalize these themes first will set the experience bar—and capture the software revenue that follows.