Bharti Airtel’s Annual Revenue Grows by 7.8% Despite Industry Challenges

Bharti Airtel, a leading telecom operator in India and Africa, has defied industry trends with a notable 7.8% increase in annual revenues, reaching nearly 1,500 billion rupees ($18 billion). The company also saw an 11.5% rise in earnings before interest and tax (EBIT), amounting to almost 393 billion rupees ($4.7 billion) for the fiscal year ending in March. Bharti Airtel, the second-largest telecom operator in India after Reliance Jio, concluded the fiscal year with 562 million customers across 16 markets. This includes over 406 million customers in India and 152.8 million in Africa.

However, Bharti Airtel is not complacent. The company aims to increase its tariffs and boost revenue from its extensive customer base. Yet, it faces the challenge of potentially losing customers if it raises prices while competitors do not. Gopal Vittal, Bharti Airtel’s Managing Director, emphasized the company’s strong year-end performance, noting a 20% reduction in customer churn and achieving a lifetime high market share across all business segments.

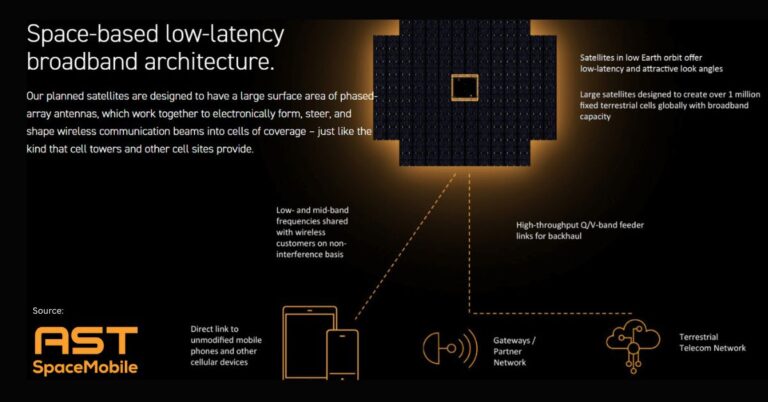

Vittal highlighted the company’s digital transformation efforts, which are gaining momentum across its operations. Despite these successes, he pointed out that the company’s return on capital employed remains low due to the lack of industry-wide tariff increases. Although significant price hikes seem unlikely, Vittal intends to leverage his position to seek regulatory relief. In the meantime, Bharti Airtel plans to expand its enterprise market revenues in India by introducing cloud and generative AI services in collaboration with Google Cloud.

Bharti Airtel Q4 FY24: Revenue Drops, Net Profit Impacted by Forex Losses

In the fourth quarter of FY24, Bharti Airtel reported a 31% decline in consolidated net profit, amounting to 2,071.6 crore rupees. This is a decrease from the 3,005.6 crore rupees recorded during the same period last year. Sequentially, net profit dropped by 15% from 2,442.2 crore rupees.

The telecom giant’s consolidated revenue from operations also decreased by 10.5% year-on-year (Y-o-Y), falling to 7,467 crore rupees from 8,345.9 crore rupees. However, revenue only marginally decreased by 0.8% from the 37,899.5 crore rupees reported in the previous quarter. The company’s mobile average revenue per user (ARPU) rose to 209 rupees in Q4, compared to 193 rupees during the same period last year.

Gopal Vittal attributed the quarterly performance impact primarily to the devaluation of the Nigerian Naira. Despite this, Airtel added 7.8 million smartphone customers and achieved an industry-leading ARPU of 209 rupees.

Bharti Airtel’s Q4 FY24 India Performance: Strong 4G/5G Subscriber Growth

India’s revenues for the fourth quarter showed a 12.9% Y-o-Y growth, reaching 28,513 crore rupees. This growth was mainly driven by the mobile segment, which saw revenue improvements due to significant additions of 4G/5G customers throughout the year. Airtel added approximately 800,000 net subscribers in Q4 2024, resulting in a total customer base of 51.2 million, including IoT subscribers.

Airtel’s Homes business continued its growth momentum, recording a 20% Y-o-Y revenue increase. The segment added 331,000 customers during the quarter, bringing the total customer base to 7.6 million. The company’s homepass rollout through asset-light partnerships with local cable operators is now operational in 1,290 cities.

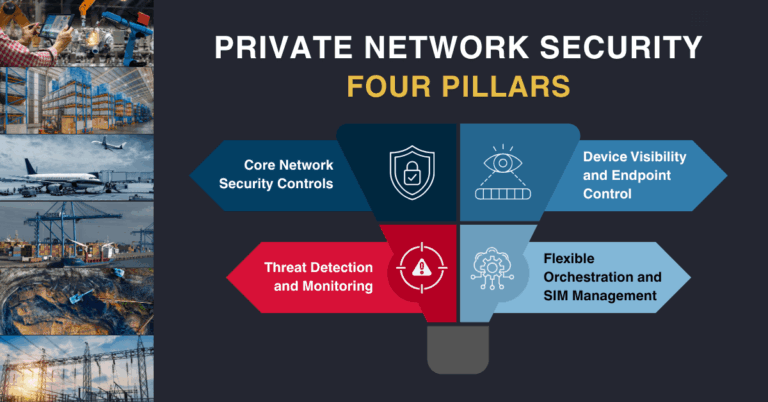

Airtel Business also witnessed revenue growth of 14.1% Y-o-Y, while the digital TV segment ended the quarter with a customer base of 16.1 million.

Airtel FY24: Annual Revenue Up, Net Profit Down Due to Exceptional Items

For the entire fiscal year, Bharti Airtel reported a 10.5% drop in consolidated net profit, totaling 7,467 crore rupees, compared to 8,345.9 crore rupees at the end of FY23. However, revenue from operations saw a 7.8% growth, reaching 1.50 trillion rupees from the previous year’s 1.39 trillion rupees.

The company board has recommended a final dividend of 8 rupees per fully paid-up equity share of face value 5 rupees each and 2 rupees per partly paid-up equity share of face value 5 rupees each for the financial year 2023-24.

Airtel FY24 Highlights: Subscriber Growth and Operational Achievements

Bharti Airtel recorded double-digit growth in its India mobile business in fiscal Q4 2024, driven by 4G and 5G customer additions and rising ARPU, but its net profit tumbled on one-off charges. MD Gopal Vittal stated the company ended the year on a strong note with consistent performance across all businesses but highlighted the need for tariff increases.

Net profit dropped 31.1% year-on-year to INR20.7 billion ($247.9 million) due to INR8.7 billion in exceptional items, mostly forex losses. Total revenue increased 4.4% to INR375.9 billion. In India, revenue grew 12.9% to INR285.1 billion, ARPU 8% to INR209, and mobile subscribers 5% to 352.3 million. The post-paid segment grew 17.5% to 23.1 million. Average monthly data usage increased 11.5% to 22.6GB. The operator stated that 74% of subscribers are on 4G and 5G plans.

Revenue in Africa rose 23% to $1.4 billion, supported by 9% subscriber growth to 152.7 million and an 11.1% increase in ARPU to $2.60. Data consumption per subscriber increased by 25% to 5.7GB. Airtel Mobile Money revenue rose 35.5% to $232 million, with active users increasing 20.7% to 38 million and ARPU up 12.5% to $2.10.

B2B service revenue increased 14% to INR54.6 billion. Full-year capex rose 15.5% to INR394.8 billion. It added nearly 99,500 base stations to end March with more than 930,000.

Analysts Upgrade Airtel: Positive Future Outlook on Revenue Growth

JP Morgan analysts upgraded Bharti Airtel Ltd. to “overweight” and increased their price target on the telecom operator, citing stronger earnings potential from increased tariffs in India and better returns on capital. JPM upgraded the stock from “neutral” and raised the price target to 1,500 rupees from 1,100 rupees, representing an upside of nearly 12% from current levels.

Airtel’s fiscal 2024 earnings were largely in line with expectations. The telecom operator clocked a 2% increase in quarterly revenue to 221 billion rupees, while adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) rose to 122 billion rupees, bringing annual EBITDA to 790.45 billion rupees.

JPM analysts now expect EBITDA to increase 9% in fiscal 2025 and 14% in fiscal 2026, driven by higher average revenue per user (ARPU) and a projected 25% hike in tariffs in the coming year. They also anticipate dividends to increase meaningfully over the next two fiscal years amid improving cash flows and further deleveraging.

Among other brokerages reacting to Airtel’s Q4 earnings, Citi reiterated its “buy” rating and target price of 1,520 rupees, while HSBC maintained a “hold” rating and slightly increased its target price to 1,220 rupees from 1,125 rupees.

Airtel’s stock rose 2.4% to 1,340.65 rupees following the earnings announcement.