Broadband Access Equipment Up as Fiber and FWA Gain Share

New Dell’Oro Group data shows Q2 2025 global broadband access equipment revenue hit $4.7 billion, up 7% quarter over quarter and 1% year over year, as fiber and fixed wireless providers capture subscribers from cable.

Q2 2025 Headline Numbers

The quarter’s growth underscores a resilient access capex cycle despite macro uncertainty, with fiber and fixed wireless access (FWA) deployments offsetting sluggish cable spend. Fiber PON platforms and 5G FWA customer premises equipment (CPE) drove the uptick, while DOCSIS infrastructure outlays fell 13% year over year on weaker Remote PHY Device (RPD) purchases and a slowdown in new virtual CMTS (vCMTS) licenses.

Why It Matters for 2025 Capex

The competitive center of gravity in broadband is shifting. Operators prioritizing XGS-PON rollouts and 5G FWA are growing faster and spending more, while cable operators are pacing upgrades and deferring some distributed access architecture (DAA) investments. As a share of total broadband equipment capex, DOCSIS infrastructure and CPE are at their lowest level since Dell’Oro began tracking the category, reinforcing a multi-year pivot toward fiber and wireless last‑mile options.

Fiber and FWA Outpace Cable Globally

Deployment momentum is broad-based, with the U.S., India, and multiple international markets leaning into FWA and continued PON expansion.

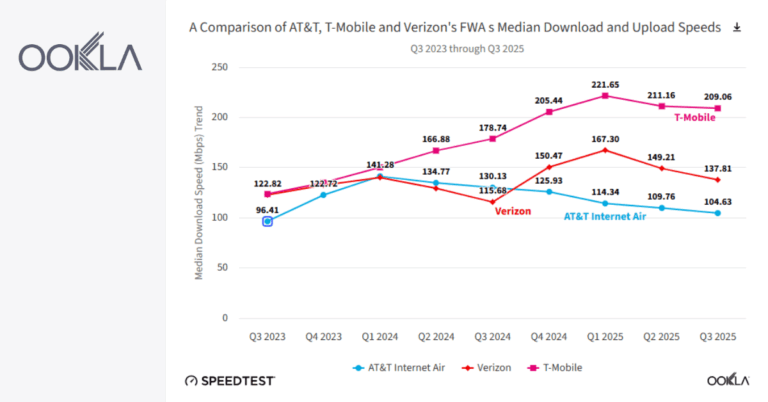

5G FWA Momentum and CPE Growth

5G FWA CPE shipments set another record in Q2 as operators add mid-band capacity and pursue self-install models to accelerate time-to-revenue. The mix remains dominated by sub‑6 GHz units, with millimeter-wave CPE volumes growing from a smaller base for dense urban and enterprise scenarios. Dell’Oro expects the FWA CPE cycle to crest in 2025–2026, making the next 12–18 months critical for footprint expansion, go-to-market bundling, and spectrum-capacity alignment.

XGS-PON Investment Cadence

On the wireline side, XGS-PON is the default choice for new builds and upgrades in North America, EMEA, and CALA, supporting symmetrical multi-gig tiers and wholesale models. Earlier Dell’Oro research projects PON equipment revenues rising from roughly $10.7 billion in 2024 to about $12.6 billion by 2029, with upside from fiber-to-the-room (FTTR) in China and early 25G/50G PON deployments in select markets. Operators are also evaluating virtual OLT (vOLT) and disaggregated architectures to improve scaling and vendor flexibility.

Cable Reset and DOCSIS 4.0 Outlook

Cable operators are tightening DOCSIS spend as they assess the pace and flavor of DOCSIS 4.0—full duplex versus extended spectrum—while continuing selective DAA rollouts. RPD purchases remain soft and vCMTS license growth slowed in the quarter, reflecting network planning discipline and inventory digestion. Some MSOs are layering targeted fiber, often using Remote OLTs (R‑OLTs) in nodes to complement HFC, while others prioritize incremental HFC upgrades before large-scale 4.0 migrations.

Technology Transitions Shaping 2025–2028

Procurement and architecture decisions in the next two years will determine cost curves, service agility, and competitive positioning for the rest of the decade.

PON Roadmap: XGS-PON Now, 25G/50G Next

XGS-PON will carry the bulk of near-term volume, with operators seeding 25GS-PON for premium enterprise, wholesale, and backhaul use cases. Several carriers are testing 50G PON to future‑proof transport for immersive applications and edge cloud, while 100G PON sits on the longer-term horizon. Key watch items: OLT port mix, optics pricing trends, and multi-vendor interoperability using industry specifications and Broadband Forum profiles.

Wi‑Fi 7 in the Home

In-home Wi‑Fi is the new bottleneck as access speeds climb, making Wi‑Fi 7 a strategic feature in both PON ONTs/gateways and 5G FWA CPE. The timing of Wi‑Fi 7 integration will influence churn, installation complexity, and support costs, particularly for multi-gig service tiers and latency-sensitive applications.

FWA CPE Peak Window (2025–2026)

With FWA CPE volumes expected to peak in 2025–2026, operators should finalize device roadmaps spanning sub‑6 and mmWave, optimize self-install success rates, and tune traffic management for video and gaming. Backhaul, power, and CPE thermal design are practical constraints that will define service quality at scale.

Operator Strategy: Where to Invest

Execution discipline—more than technology choice—will separate leaders from laggards as competitive overlap intensifies.

Guidance for Cable/MSOs

Make clear calls on DOCSIS 4.0 paths and sequencing, accelerate DAA where it reduces opex, and deploy R‑OLTs for targeted fiber overlays where economics are favorable. Refresh home gateways to Wi‑Fi 7 on multi-gig tiers, and explore converged offers with mobile/FWA to defend footprint. Align vCMTS investments with subscriber density and node splits to avoid stranded licenses.

Guidance for Telcos and Altnets

Scale XGS-PON OLT ports and ONT inventory, lock optics supply, and pilot 25GS‑PON for enterprise and wholesale. Evaluate vOLT and disaggregated OLTs to diversify vendors and drive automation, and invest in in‑home Wi‑Fi optimization to translate access speed into perceived performance. Monitor build-to-budget risks as construction and labor costs fluctuate.

Guidance for Wireless Operators

Plan mid-band capacity with a conservative view on traffic growth, deploy mmWave tactically for MDUs and dense suburbs, and balance indoor CPE with outdoor units where link budgets are tight. Use converged billing and service tiers to raise ARPU while managing video-heavy usage patterns.

Vendor Implications and Competitive Landscape

Portfolio mix matters as spend shifts from DOCSIS to PON and FWA, with software, automation, and CPE differentiation rising in importance.

Where Demand Is Flowing

PON and broadband CPE suppliers stand to benefit—think Nokia, Adtran, and Calix in OLT/ONT, alongside CPE specialists such as Zyxel and ZTE—while 5G FWA device makers ride the peak shipment window. On the cable side, DAA and virtualization specialists like Harmonic and CommScope are positioned where operators continue node densification and virtualized cores.

Risks for DOCSIS-Heavy Portfolios

Vendors concentrated in legacy DOCSIS infrastructure face a tougher near-term outlook as operators delay RPD purchases and temper vCMTS license growth. Pivot strategies include fiber access, remote OLTs, Remote MACPHY options, and software-led value (QoE analytics, Wi‑Fi management, automation).

Key Metrics to Track in 2H 2025

A few signals will indicate whether fiber and FWA can sustain their lead and how fast cable rebounds with DOCSIS 4.0.

Deployment Velocity

Watch quarterly XGS-PON OLT port shipments, 5G FWA CPE unit trends, and initial DOCSIS 4.0 node activations. Rising Wi‑Fi 7 gateway attach rates will also correlate with premium tier uptake.

Capex Guidance and Inventory

Listen for updated spending plans from North American MSOs, Indian mobile operators, and EMEA altnets, plus commentary on inventory normalization across OLTs, CPE, and DAA components.

Policy and Funding

Public broadband programs, including U.S. BEAD and analogous initiatives in other regions, will influence fiber build pacing, rural FWA coverage, and vendor backlogs.

Bottom Line

The market is tilting toward fiber and FWA, pressuring cable economics and reshaping vendor priorities as operators race to deliver multi‑gig, low‑latency access.

Next Steps

Rebalance 2025–2026 roadmaps toward XGS-PON and peak‑window FWA, clarify DOCSIS 4.0 timing, and align CPE with Wi‑Fi 7 to protect experience at the edge. Build cross‑domain automation and analytics to squeeze opex, and lock critical optics and chipset supply ahead of seasonal ramps. The winners will pair disciplined capex with architectural flexibility to navigate demand shifts and technology inflection points.