Why S&P upgraded Bharti Airtel: pricing, cash flow, 5G

S&P Global Ratings has upgraded Bharti Airtel on the back of stronger earnings quality, healthier free cash flow, and a clearer deleveraging path, signaling a maturing Indian mobile market.

Pricing discipline and ARPU monetization momentum

The action reflects rising confidence that India’s tariff repair is sticking after mid-2024 hikes, with average revenue per user moving up and a larger share of premium 4G/5G subscribers. For a sector long constrained by low pricing, the upgrade acknowledges Airtel’s ability to convert usage growth into cash, not just headline data traffic. That translates into steadier funding for 5G densification, fiber, and enterprise platforms—without over-reliance on new debt.

Lower borrowing costs and 5G/fiber investment flexibility

A stronger rating can shave basis points off future borrowings and improve market access for spectrum refinancing, tower/edge buildouts, and selective M&A. It also widens Airtel’s strategic room to prioritize quality-of-service investments (coverage, indoor performance, latency) that underpin differentiated 5G experiences and premium plans, while keeping leverage trending down.

Q2 results: ARPU above INR 200 and cash discipline

Airtel’s fiscal Q2 (India) showed operating momentum and cash discipline—key ingredients behind the rating move.

ARPU > INR 200, premium 4G/5G mix and postpaid gains

Tariff increases and a richer subscriber mix pushed ARPU above the psychologically important INR 200 threshold, aided by postpaid gains, 4G/5G migration, and bundled content. The company leaned into churn management and upsell rather than promotional volume, a sign of a healthier, more rational three-player market alongside Reliance Jio and Vodafone Idea. In fixed-line, fiber-to-the-home additions continued, reinforcing a converged strategy that supports higher lifetime value.

Capex moderates; NSA-led 5G with targeted SA

With the rapid 5G rollout largely past peak intensity, capital intensity began to moderate. Airtel’s 5G architecture remains anchored in non-standalone (NSA) for broad coverage and device compatibility, with targeted investments toward standalone (SA) capabilities where enterprise slicing, ultra-low latency, and deterministic QoS are needed. The mix shift helps free cash flow turn positive even as the company keeps densifying urban sites, adding mid-band capacity, and extending fiber backhaul.

Deleveraging path: stronger FCF, lower net debt/EBITDA

Improving free cash flow and steadier operating metrics give Airtel a clearer path to deleveraging while sustaining network leadership.

FFO-to-debt improves; net debt/EBITDA trending down

S&P pointed to improving funds-from-operations relative to debt and better visibility on sustained cash generation as core to the upgrade. Net debt-to-EBITDA is moving lower, supported by disciplined capex, tariff repair, and operating leverage in India, complemented by stable contributions from Airtel Africa. The rating agency also highlighted execution on cost control and capital allocation, factors that support resilience through competitive cycles.

Lower cost of capital and ROI-driven capex cadence

A stronger credit profile can marginally reduce the cost of capital, important for spectrum payments, network modernization, and refinancing. Expect Airtel to keep prioritizing high-return projects: urban 5G densification, fiber deepening for backhaul and FTTH, cloud and security services for enterprises, and selective expansion of data centers and edge locations tied to latency-sensitive workloads.

India telecom shift: quality-led growth and enterprise 5G

The upgrade is a barometer for the Indian telecom sector’s shift from volume-led growth to sustainable, quality-led monetization.

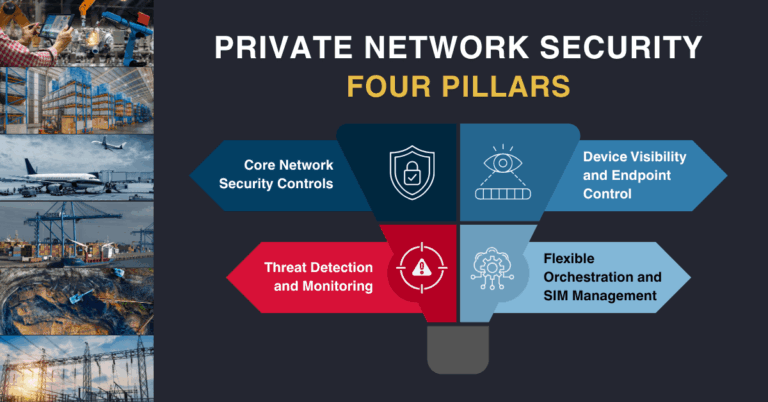

Enterprise 5G roadmaps: private 5G, slicing, APIs

With cash flow momentum and rating headroom, Airtel is better positioned to scale managed services—private 5G, campus Wi-Fi, SD-WAN/SASE, IoT, and network APIs aligned with GSMA Open Gateway principles. Buyers should see improved SLAs, wider availability of 5G SA pilots for slicing and deterministic latency, and tighter integration with hyperscaler clouds for AI/edge workloads.

Competitive outlook: tariff discipline and ROI-first solutions

The signal to the market is that tariff discipline is likely to persist. Reliance Jio will continue to push coverage and bundling; Vodafone Idea’s turnaround hinges on capital access and network upgrades. For vendors and integrators, Airtel’s steadier investment posture favors solutions that lower total cost of ownership, enable automation (RAN energy savings, cloud-native cores), and monetize enterprise use cases rather than headline throughput alone.

Watch list: ARPU, SA monetization, capex and policy risks

Execution, policy, and competitive dynamics remain pivotal to sustaining the credit and equity narratives.

ARPU trajectory and timing of next tariff actions

Monitor whether ARPU continues to climb through a richer mix and potential future tariff actions without reigniting price wars. Postpaid share, broadband net-adds, and churn are leading indicators.

5G SA, slicing pilots, and edge revenue conversion

Track pilots moving to production for SA, network slicing, and low-latency enterprise services in manufacturing, logistics, and media. Revenue conversion from proofs-of-concept will determine the slope of enterprise monetization.

Balancing FCF with QoS and 5G availability

Watch capex-to-sales levels and KPIs like 5G availability, mid-band capacity, and indoor coverage. The balance between free cash flow and premium network experience is central to sustaining ARPU.

Spectrum dues and regulatory liabilities visibility

Spectrum installments and legacy regulatory liabilities must remain predictable within cash generation. Any policy shifts impacting fees or spectrum strategy would alter the deleveraging path.

Africa exposure, FX, and diversification effects

Airtel Africa’s dividend upstreaming, local currency volatility, and macro trends will influence group liquidity. Diversification helps, but currency and regulatory risks need monitoring.

Takeaways: cash-generative growth fuels 5G and fiber

S&P’s upgrade validates Airtel’s pivot to cash-generative growth and supports a lower-cost, higher-confidence investment cycle in 5G, fiber, and enterprise services.

Actions for buyers, vendors, and investors

Enterprises should use the current window to negotiate multi-year, SLA-backed 5G/FTTH bundles and explore private 5G and edge pilots tied to measurable outcomes. Vendors should focus on energy-efficient RAN, automation, and cloud-native cores to align with Airtel’s ROI thresholds. Investors should watch ARPU, free cash flow, and SA commercialization pace as the key proof points that the rating momentum can hold.