Singtel sells 0.8% Airtel stake, unlocks S$1.5B

Singtel has sold another slice of its Bharti Airtel holding, freeing up capital to fund growth while continuing to rebalance a long-standing strategic investment.

Airtel selldown details and valuation

Singapore-based Singtel monetised roughly 0.8% of Airtel for about S$1.5 billion (approximately US$1.2 billion), recording an estimated net gain of S$1.1 billion. The move follows a sale of around 1.2% in August for roughly S$2 billion. Post-transaction, Singtel’s ownership in Airtel stands at about 27.5%, with the residual stake valued in the region of S$51 billion based on prevailing market prices. Airtel remains India’s second-largest mobile operator with roughly 364 million mobile connections, underscoring the scale of the asset Singtel continues to hold.

Capital recycling strategy and balance sheet

The sale is part of a multi-year capital management programme launched in 2021. With this latest step, Singtel has now generated about S$5.9 billion, roughly half of its new mid-term target of S$9 billion. Management has framed the initiative as a way to strengthen the balance sheet and redeploy capital into higher-growth digital infrastructure and digital services, while progressively equalising its Airtel ownership with Bharti Enterprises over time. Singtel still commands leading share in its home market, but the group’s equity interests across Asia—and its capital recycling cadence—are increasingly central to its strategy.

Why the Airtel selldown matters for telecom and digital infra

The timing and scale of the monetisation reflect where growth, returns, and capital intensity are converging across the sector.

Stronger balance sheet expands growth options

By harvesting gains from a mature, liquid asset, Singtel creates room to self-fund expansion in adjacencies that carry stronger growth profiles than legacy connectivity. That includes data centre capacity, cloud-aligned platforms, enterprise solutions, and security—areas that demand upfront investment but can deliver recurring, higher-margin revenue. In a rate-sensitive environment, internal funding can be more attractive than incremental debt, preserving flexibility for M&A, network modernisation, and co-investments.

Portfolio rotation playbook for telcos

Large operators are increasingly recycling capital from passive or listed holdings to fund digital infrastructure and platform bets. Singtel’s Airtel stake has long been a strategic anchor; monetising portions at favourable valuations improves capital efficiency without severing exposure to India’s growth story. The approach also lowers concentration risk, aligns with governance expectations around disciplined capital allocation, and signals to investors that return on invested capital is a priority.

What it means for Airtel, India, and ASEAN markets

The transaction has ownership, market, and valuation signals worth watching for operators and investors exposed to India and Southeast Asia.

Ownership alignment and market structure impacts

Singtel’s step-down to roughly 27.5% supports the stated goal of gradually aligning stakes with Bharti Enterprises, Airtel’s parent group. While the sale marginally increases Airtel’s free float in the near term, Singtel remains a significant strategic shareholder. For India, where market structure has stabilised around a few scaled players, continued backing from long-term institutions supports Airtel’s investment capacity in 5G, fiber, and enterprise services. Airtel’s scale—hundreds of millions of connections—continues to underpin operating leverage, even as the ARPU and premium tier mix remain key profit drivers.

Valuation and liquidity signals for investors

The implied valuation of Singtel’s remaining Airtel stake—around S$51 billion—highlights how investor appetite for Indian digital assets remains robust. Liquidity events of this size at healthy multiples tend to reinforce confidence in the asset class and provide a reference point for future portfolio actions across the region. For regional telcos, the message is clear: listed equity in high-growth markets can be a powerful funding source, provided timing and market depth are supportive.

Where Singtel plans to deploy proceeds

The company has been explicit about reallocating proceeds to where it sees durable growth and differentiated capability.

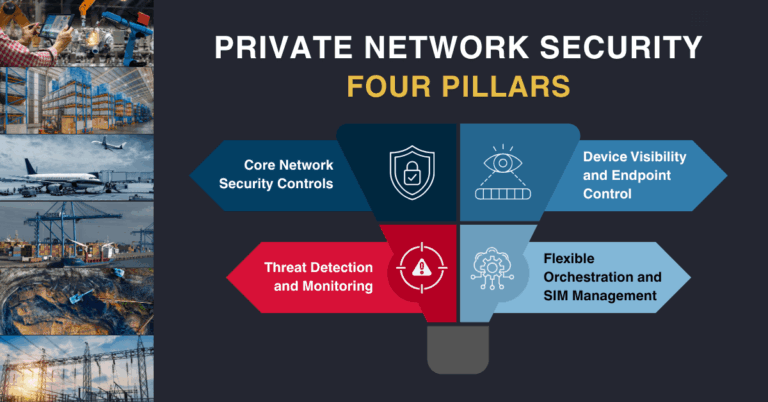

Data centers, cloud, security and platform growth

Expect a focus on expanding digital infrastructure footprints and enterprise services. That can include additional data centre capacity, edge-ready connectivity, cloud networking, managed security, and platform-led solutions for multinational customers. These bets align with rising AI and cloud demand in Asia, where hyperscalers, SaaS vendors, and domestic enterprises require low-latency capacity and integrated network-to-cloud architectures.

5G, transport upgrades and ASEAN co-investments

Proceeds can also support 5G enhancements, transport upgrades, and automation to lower unit costs and improve service agility across Singtel’s operating companies and associates. Selective co-investments and partnerships across ASEAN may follow, particularly where Singtel can combine network assets with digital services to capture enterprise wallet share.

Key milestones and risk factors to watch

Several catalysts will indicate how this portfolio strategy translates into execution and returns.

Tracking progress toward the S$9B target

Investors will track the pace and pricing of any additional monetisation steps as Singtel moves toward its S$9 billion mid-term target. The balance between further Airtel selldowns and other asset actions will reveal management’s view on relative value, risk, and strategic importance.

Buildout milestones and ROI disclosure

Watch for announcements on new digital infrastructure builds, JV structures, or platform launches, and for clearer disclosure on returns. Evidence of utilisation ramp, backlog, and cross-sell into enterprise accounts will be key signals that capital is translating into durable growth.

Market, currency and policy conditions

Macro variables—Indian equity market conditions, currency movements, and regulatory policy—could influence the timing of any future stake moves. On the operating side, enterprise demand for AI-ready infrastructure and secure, managed connectivity will shape the opportunity set.

Strategy lessons for operators and investors

The transaction underscores practical lessons for telecom leaders managing through capital-intensive transitions.

Sequence capital recycling to valuation windows

Use liquid, mature holdings to fund growth that improves the portfolio’s long-term returns, while maintaining optionality in strategic assets. Sequence sales to market liquidity and valuation windows rather than fixed timetables.

Invest in digital infra where telco moats compound

Prioritise digital infrastructure and services that leverage network assets, spectrum, and customer relationships, creating defensible margins beyond basic connectivity.

Anchor growth in balance sheet discipline

Balance sheet strength is a strategic asset. Reinforce it during portfolio rotation so the company can invest through cycles and partner from a position of stability.