Intel is carving out its Network and Edge (NEX) division as a standalone business as part of a sweeping restructuring plan to refocus the company on x86 and AI priorities. The move follows a dismal quarter where Intel reported a $2.9 billion loss and announced plans to cut 15% of its workforce, reducing headcount to around 75,000 by the end of 2025.

Intel’s NEX Spin-Off: A Strategic Pivot

The NEX group, which encompasses networking silicon, Ethernet solutions, and communications infrastructure, will operate independently while Intel retains an “anchor investor” role. The company is seeking outside investors for the new entity, mirroring the approach it used earlier this year when it sold a majority stake in its Altera programmable logic business to private equity firm Silver Lake.

Sachin Katti, Intel’s AI strategy lead and head of NEX, stated that the new company will have the flexibility to “accelerate its customer-facing strategy and product roadmap by innovating faster and investing in new offerings.” The spin-off aims to remove corporate bottlenecks and allow NEX to better compete in a market increasingly driven by AI workloads and high-performance networking.

AI Shift and Exit from Non-Core Segments

Under CEO Lip-Bu Tan, Intel is pivoting sharply toward an AI-first strategy. Tan has described the company as “overextended and inefficient,” signaling a move away from legacy segments that do not align with Intel’s core x86 and AI roadmap. The decision to spin off NEX is emblematic of this philosophy shift, as Intel attempts to streamline its operations and regain competitiveness in critical markets.

Tan also hinted that Intel’s ambitious 14A (1.4nm-class) process node could be shelved unless the company secures a major external customer, underscoring the high stakes of Intel’s ongoing transformation. Without such customers, Intel risks ceding advanced process leadership entirely to rivals TSMC and Samsung.

Telecom Implications and Industry Reactions

Intel’s exit from direct control of NEX has raised concerns in the telecom sector, where its chips are widely used in 5G base stations and Open RAN deployments. Ericsson, a major Intel customer, could be significantly impacted by any disruption in supply or changes in technology direction. Industry analysts have speculated that Ericsson might even explore investing in NEX to secure its supply chain, though ownership conflicts could complicate such a move.

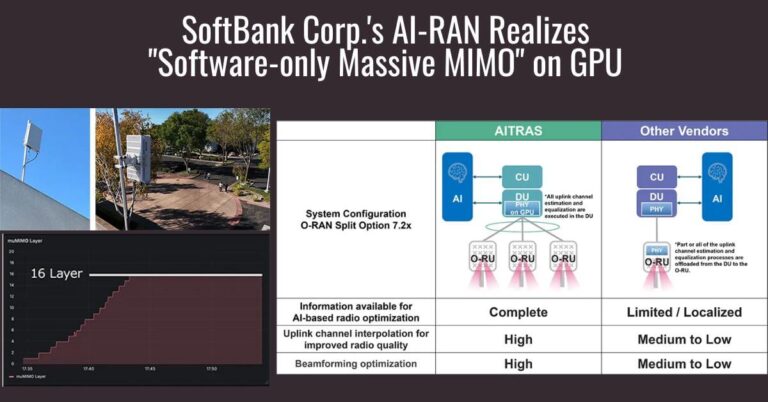

Intel’s NEX portfolio is deeply embedded in both traditional and virtual RAN systems. Its Atom P5900 (Snow Ridge) SoC became a staple for 5G base station deployments, making Intel a critical supplier to Ericsson, Nokia, and ZTE. With the spin-off, questions arise over how the new company will balance existing telecom partnerships while navigating the rapidly evolving AI and networking landscape.

Competition Intensifies in AI and Networking

Intel has struggled to keep pace with competitors in high-speed networking. While Intel is rolling out its 200GbE NICs, rivals like NVIDIA and Broadcom are already shipping 400GbE and preparing 800GbE solutions. The surge in AI-driven networking demand has highlighted Intel’s lag, with hyperscale data centers and AI training clusters increasingly relying on advanced interconnects.

The spin-off could provide NEX with the agility to respond to these market shifts. However, Intel’s broader financial struggles and reduced capital expenditure — dropping from $23.9 billion in 2024 to an expected $18 billion in 2025 — cast uncertainty over whether the company can sustain its aggressive roadmap while shedding key business units.

Restructuring at a Critical Juncture

Intel’s restructuring comes as it faces mounting pressure on multiple fronts:

-

AI competition: NVIDIA’s GPU dominance and AMD’s data center gains have eroded Intel’s market share.

-

Process technology delays: Intel’s 18A node has slipped, with “peak volumes” not expected until the early 2030s.

-

Telecom dependency: Virtual RAN, while growing, still represents a small share of the RAN compute market, leaving Intel’s traditional base station business vulnerable to shifts in vendor alliances.

Despite these challenges, Intel’s core CPU roadmap remains intact. The Panther Lake platform, built on the 18A node, is slated for late 2025 with a strong focus on AI performance and the reintroduction of Hyper-Threading on P-cores. Granite Rapids continues development on the server side, though AMD’s EPYC lineup poses stiff competition.

What Comes Next for NEX

Intel’s decision to spin off NEX mirrors the Altera playbook and signals that the company sees more value in separating certain units to unlock investment and agility. For NEX, independence could mean faster innovation and a sharper customer focus, particularly in the edge computing and telecom sectors.

Finding the right investors will be critical. Industry watchers expect a mix of financial and strategic interest, possibly from private equity firms or telecom equipment makers seeking to secure their supply chains. Intel’s continued stake ensures it will benefit if NEX succeeds, but the spin-off underscores how drastically Intel is reshaping itself to survive in a rapidly changing semiconductor landscape.

A Defining Moment for Intel’s Future

The NEX divestiture is more than a financial maneuver — it is a defining moment in Intel’s bid to reclaim relevance in AI and high-performance computing. Whether this strategy stabilizes the company or accelerates its decline depends on its ability to execute its AI roadmap, deliver competitive products, and maintain critical industry partnerships during a period of profound transformation.