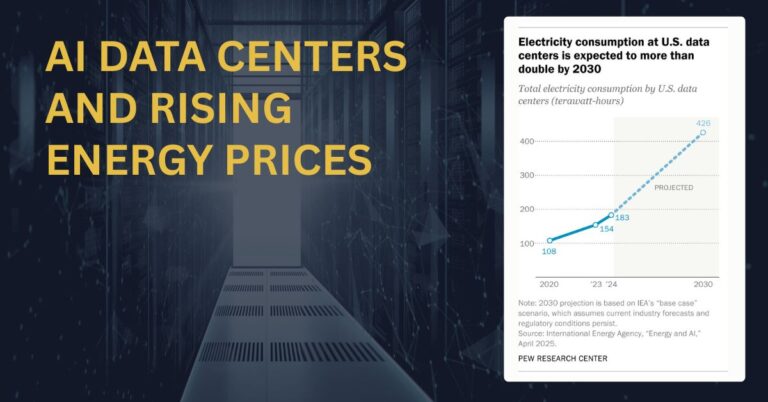

AI Data Centers, Energy Prices, and the New Power Reality

AI buildouts have flipped a decade of flat U.S. electricity growth into a structural uptrend, with consumer price concerns rising in parallel.

From Flat Demand to Structural Load Growth

After years of steady demand, U.S. load is climbing as commercial and industrial users tap more power, and hyperscale data centers are now a central driver of the shift.

Data centers are estimated to consume roughly 4% of U.S. electricity today—more than twice their share in 2018—and some credible scenarios place that figure in the high single digits to low teens by 2028, depending on the trajectory of AI training and inference footprints.

Most large tech platforms have signed multi‑gigawatt renewable deals to keep pace because solar, wind, and grid‑scale batteries can be deployed faster and at lower levelized costs than other options, particularly utility‑scale solar with 12–24 month build cycles.

Rising Bills Turn Public Concern into Policy Risk

A strong majority of consumers say they worry data centers will raise their utility bills, and that sentiment can convert quickly into local permitting resistance, siting delays, and regulatory scrutiny of special service tariffs for large loads.

For operators, rising retail rates and social license risk now sit alongside land, fiber, and water as gating factors for where AI capacity gets built.

Power Supply Bottlenecks Amid Surging AI Demand

The generation mix that can scale fast enough is narrowing as gas equipment backlogs, policy uncertainty, and supply chains adjust to AI‑era loads.

Renewables Lead Growth, Incentives and Transmission Remain Uncertain

Renewables dominate new interconnection requests and near‑term additions, aided by maturing battery storage that shifts solar output into evening peaks and templated PPA structures favored by cloud providers.

However, shifting federal policy stances on tax credits and transmission can slow project timelines, increase financing costs, and widen the gap between what data centers want and what the grid can deliver by mid‑decade.

Gas Turbines and Grid Equipment Backlogs Raise Costs and Delays

Natural gas remains a preferred firming option for many developers, but new combined‑cycle plants take years, and OEM backlogs for turbines, large transformers, breakers, and switchgear stretch well into the second half of the decade.

Even where gas is abundant, long lead times for equipment and interconnection upgrades are raising the all‑in cost and risk profile of gas‑anchored strategies.

Nuclear Options Have Ambition but 2030s Timelines

Advanced nuclear and small modular reactors have strong backers across tech and utilities, yet commercial scale is unlikely before the 2030s, making them a planning thesis rather than an immediate capacity solution for 2026–2029 AI sites.

Utility Planning Strained by Competing AI Megaprojects

Simultaneous, overlapping requests for gigantic loads are stressing forecasting, which directly affects customer bills and multi‑billion‑dollar grid investment plans.

Load Forecast Volatility Drives Multi‑Billion Capex Risk

Regulators and utilities warn that small deviations in load forecasts can swing capital plans by billions, while tech firms often “shop” similar data center footprints across multiple regions to secure the fastest power path.

That approach complicates long‑range resource adequacy, risks stranded investment if projects shift, and sharpens debates over who pays for upgrades—general ratepayers or the requesting load via network charges and special contracts.

Interconnection Queues and Transmission Delays Slow Energization

Interconnection queues are dominated by solar, storage, and wind, but study backlogs, permitting hurdles, and transmission congestion delay energization, even for shovel‑ready sites.

Meanwhile, utilities are already spending at record levels on grid modernization, with trillions in planned capex through the decade, raising pressure to sequence projects that enable the highest load certainty at the lowest system cost.

Implications for Telecom, Cloud Regions, and Edge Strategy

Power has become the first design constraint for data center, cloud region, and edge siting—and that will reshape network architecture and procurement for years.

Power‑First Site Selection and Design

Expect hyperscalers and carriers to prioritize metros with firm capacity, shorter interconnection timelines, and clear green tariff options, even if network latency is slightly higher than ideal.

Geographic diversification across ISOs, tapping municipals and co‑ops, and co‑siting near substations or industrial parks with excess capacity can de‑risk schedules.

Efficiency Stack from Silicon to Liquid Cooling

Rising rack densities and GPU clusters make efficiency non‑negotiable: adopt next‑gen accelerators with higher TOPS/W, aggressive power capping for inference, workload scheduling to align with renewable availability, and liquid cooling to lower PUE and water use where feasible.

For telcos, turn on 5G energy‑saving features, leverage RAN Intelligent Controller apps for dynamic carrier shutoff, and push traffic engineering that consolidates load into the most efficient sites during off‑peak windows.

Grid‑Tied, Hybrid, and Behind‑the‑Meter Power Options

Behind‑the‑meter generation—solar‑plus‑storage, reciprocating engines with RNG/H2 blends, or CHP—can accelerate timelines and hedge price risk, but it introduces operational complexity and permitting trade‑offs.

Hybrid designs that stay grid‑connected while adding onsite storage for peak‑shaving and backup will be a pragmatic middle path for many campuses and edge clusters.

Commercial Levers: Renewable PPAs, Green Tariffs, and Hedging

Lock in multi‑year renewable PPAs aligned to 24/7 matching goals, use utility green tariffs where available, and layer financial hedges to stabilize exposure to volatile wholesale markets.

Require firm capacity commitments from utilities before committing to full campus builds, and stage deployments to milestone power deliveries to avoid stranded capex.

What Decision‑Makers Should Do Next on Power and AI

Leaders should treat power as a portfolio risk and redesign governance, procurement, and architecture around it now.

Near‑Term Moves (0–12 Months) for Power Readiness

Map your compute roadmap to power availability by ISO and substation, including interconnection queue status and equipment lead times; prioritize sites with executable 24‑month paths.

Negotiate conditional PPAs and green tariffs with step‑ups tied to energization milestones; secure transformer and switchgear slots early through frame agreements.

Deploy efficiency measures that deliver fast payback: liquid cooling pilots, AI workload orchestration, inference quantization, and RAN energy features across high‑traffic clusters.

Mid‑Term Strategy (12–36 Months) for Hybrid Power

Build a hybrid power playbook combining grid contracts with onsite storage and limited generation for peak‑shaving and resiliency at priority regions and metro edge nodes.

Re‑sequence network and edge expansions to markets with clearer power pathways, and push vendor roadmaps toward higher performance per watt and open cooling standards.

Watch List: Policy, Equipment Lead Times, Interconnection

Monitor federal tax credit policy and transmission reforms, turbine and transformer lead times, interconnection process changes, and nuclear demonstration milestones.

Track AI demand signals with signed offtake, not press releases; require firm commitments from partners to avoid overbuilding and to protect customers from rate shock.