TeckNexus Monthly Industry Briefing

November 2025 Edition

October 2025 marked a pivotal month across telecom, technology, and digital infrastructure — from billion-dollar M&A and AI-driven expansion to private 5G deployments and next-generation connectivity. This briefing highlights key moves shaping the future of networks, automation, and AI-powered innovation.

M&A, Investments, Growth, Partnerships, and Layoffs

Executive Briefs

AWS commits $50B to expand U.S. federal AI and HPC cloud infrastructure across AWS Top Secret and Secret regions, marking one of the largest sovereign AI investments planned for 2026 onward.

Nokia launches a $4B U.S. AI-ready network initiative, expanding domestic R&D, defense-grade networking, quantum-safe systems, and semiconductor innovation.

Deutsche Telekom’s Industrial AI Cloud wins the SOOFI contract, enabling a sovereign 100B-parameter open-source LLM for Europe’s industrial and language needs.

India 5G to reach 1B users by 2031, per Ericsson’s Mobility Report, signaling deep modernization and accelerating ARPU expansion across the region.

Verizon restructures with 13,000+ job cuts, shifting toward AI-first operations and a streamlined cost base for the next phase of network and services growth.

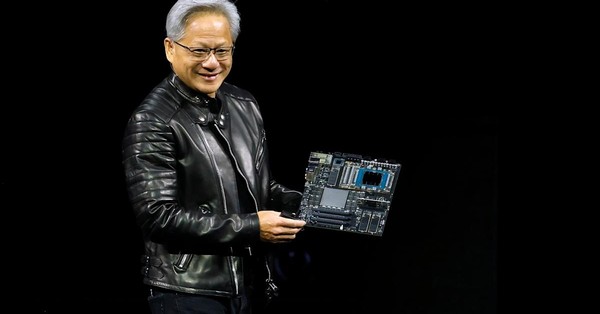

NVIDIA posts $57B revenue, reinforcing the global AI infrastructure boom as governments, clouds, and enterprises scale GPU-driven data centers.

Palo Alto Networks acquires Chronosphere for ~$3.35B to merge AI-driven observability with cloud security operations.

Airbus debuts Agnet Direct, a multi-mode mission-critical extension validated on France’s RRF network for high-reliability communications.

Jio bundles 18-month Google Gemini Pro access across its 5G subscriber base, positioning AI services as a central monetization layer.

Nokia outlines its AI strategy for 6G and AI-native networks, sharpening capital allocation and customer co-innovation.

Alibaba.com launches AI Mode, bringing agentic AI automation to global B2B sourcing workflows.

CTIA Catalyst Program reaches 30M people, showcasing mobile-first innovation’s national-scale impact on public safety and social outcomes.

Orange to launch Europe’s first NTN D2D SMS service, enabling satellite-connected messaging and location sharing outside terrestrial coverage.

Google announces $40B Texas AI data centers, reinforcing hyperscale expansion toward power-dense, AI-optimized regions.

Jeff Bezos returns as co-CEO of Project Prometheus, a $6.2B AI venture focused on industrial and physical-economy applications.

Bharti Airtel receives S&P upgrade, supported by strong Q2 performance, rising ARPU, and disciplined 5G capital deployment.

Jio appeals to TRAI for flexible 5G net-neutrality rules, emphasizing slicing-enabled URLLC, cloud gaming, and broadcast-grade QoS.

Verizon reportedly preparing 15,000 additional layoffs and franchising up to 200 stores to accelerate cost restructuring.

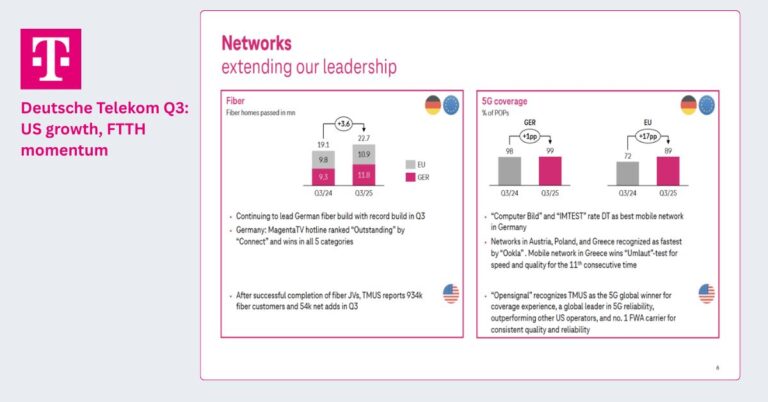

Deutsche Telekom Q3 results show U.S. momentum and strong FTTH growth, prompting raised full-year guidance.

Amazon rebrands Project Kuiper as “Amazon Leo,” signaling readiness for commercial LEO broadband services.

AST SpaceMobile targets early 2026 for intermittent nationwide D2D coverage with continuous service later that year.

Google invests €5.5B in Germany for AI-ready cloud infrastructure centered in the Frankfurt Rhine-Main region.

SoftBank exits Nvidia, reallocating over $5.8B toward next-generation AI infrastructure and platform investments.

Jio prepaid launches new AI- and OTT-bundled 5G plans, reflecting a shift toward service-led monetization.

Anthropic commits $50B to U.S. AI data centers, prioritizing domestic compute sovereignty and power-dense campuses.

HPE forms a Quantum Scaling Alliance, advancing hybrid, fault-tolerant quantum architectures tied to HPC systems.

Nokia and LMT co-develop tactical 5G for Baltic defense, integrating secure high-capacity battlefield communications.

SK Group plans a 30% executive reduction, streamlining leadership across SK Telecom and affiliates to accelerate AI-led decision cycles.

Vodafone × AST SpaceMobile pursue a sovereign D2D NTN model for Europe, enabling direct-to-device satellite broadband under national frameworks.

Telus seeks partners for Canadian AI data centers, aiming to scale sovereign AI compute with capital-light structures.

Singtel sells part of its Airtel stake for S$1.5B, freeing capital while retaining long-term strategic exposure.

Telefónica Q3 shows expanded 5G/fiber footprint, with stable organic growth amid macro headwinds.

Snapchat integrates Perplexity AI in a $400M partnership to deliver native conversational search for 2026 rollout.

Telefónica’s 2026–2030 plan targets €3B in savings and accelerates growth via simplification and tech modernization.

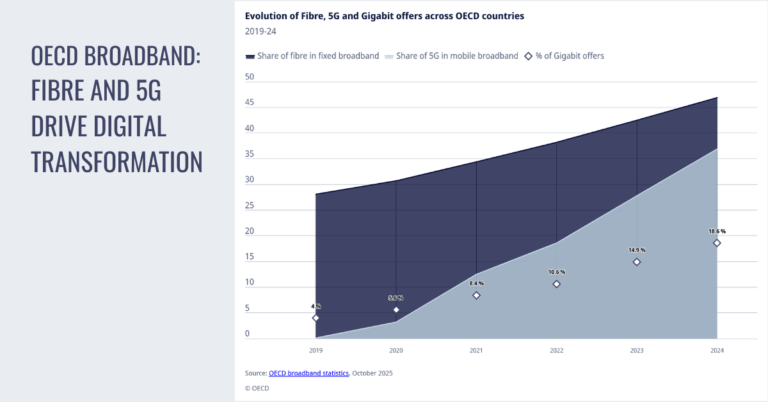

OECD broadband analysis shows fiber and 5G driving global digital transformation, with record penetration levels.

Orange to acquire full control of MasOrange for €4.25B, consolidating Spain’s largest telecom operator.

KPN, Odido & Vodafone NL launch national CAMARA fraud APIs, aligning with GSMA’s Open Gateway security vision.

Telus completes Digital division takeover for $539M, aligning AI CX, SaaS, and automation under one operating model.

Hyundai × NVIDIA plan a Blackwell-powered AI factory, uniting robotics, autonomous driving, and smart manufacturing.

Samsung deploys 50,000+ NVIDIA GPUs to power AI-driven manufacturing, chip design, and robotics transformation.

Related Posts

Private 5G/LTE and CBRS Networks

Executive Briefs

Frankfurt Airport scales one of the world’s largest private 5G networks with NTT DATA and Nokia, enabling real-time operations, autonomous systems, predictive maintenance, and next-generation airport digitization.

Nokia powers remote mining connectivity at Salinas Gold (Brazil) with a fiber-backed LTE network delivered alongside Venco and Ávato, setting a new benchmark for resilient industrial connectivity in unserved regions.

Thiess advances autonomous mining through a private LTE platform from Aqura Technologies supporting haul trucks, drills, safety systems, and real-time field collaboration — with a roadmap moving toward 5G and AI.

Lufthansa Cargo boosts warehouse efficiency at LAX via private 5G, eliminating Wi-Fi dead zones and reducing operational cycle times by up to 80%, enabling scalable digital logistics across U.S. hubs.

Miami International Airport modernizes operations with a private CBRS network, forming the backbone of its Smart Airport 2.0 vision with secure IoT automation, enhanced cybersecurity, and tenant monetization models.

Niral Networks deploys private 5G + Edge AI at GMR’s energy facility, delivering an air-gapped industrial network supporting plant automation, AI surveillance, drone operations, and centralized multi-site control.

Druid Software & LMT deliver Latvia’s first private 5G networks at Riga’s BCT Terminal and the Freeport of Riga, enabling ultra-reliable automation, real-time data flows, and safer, more productive port operations.

Invences & Trilogy Networks transform U.S. agriculture with FarmGrid — a private 5G + edge AI platform driving 20–30% yield gains, 25% resource savings, and climate-resilient smart farming.

Spirent accelerates enterprise-grade 5G with automated SLA assurance, multi-vendor integration validation, and CI/CD/CT workflows adopted by operators like Telefónica for scalable private 5G delivery.

OneLayer introduces device-centric private 5G/LTE security, unifying IT, OT, and cellular visibility with ONEID fingerprinting and zero-trust segmentation for mission-critical environments.

Palo Alto Networks brings AI-powered Zero Trust to private 5G, securing data, devices, and industrial workloads across IT and OT domains — a foundational layer for Industry 4.0 deployments.

India’s 6 GHz spectrum debate intensifies, with global tech ecosystems urging unlicensed use for Wi-Fi while operators advocate for licensed IMT to support 5G growth.

Airbus expands mission-critical broadband with Agnet Direct, enabling secure, multi-mode communications even when private or commercial coverage is disrupted — validated on France’s RRF.

CAF & Cellnex validate CBTC over private 5G, confirming resilient performance in tunnels and complex rail environments using multi-access (Wi-Fi, LTE, 5G) architectures.

Ericsson delivers neutral-host 5G small cells at Boston’s 10 World Trade, showcasing a scalable indoor model for multi-operator enterprise buildings.

Nokia + OneLayer strengthen private 5G/LTE security for utilities, integrating OT-aware visibility, authenticated device identity, and role-based segmentation for distributed mission-critical grids.

Private 5G/LTE and CBRS Networks | Featured Content

Sponsored by: OneLayer

Private 5G/LTE and CBRS Networks | Deployments

Private 5G/LTE and CBRS Networks | Industry Updates

Connectivity (5G, 6G, Broadband, NTN)

Executive Briefs

India’s 6 GHz spectrum battle intensifies, with global device/cloud ecosystems pushing for unlicensed Wi-Fi while operators lobby for IMT licensing to support national 5G capacity growth.

6G spectrum planning accelerates, as GSMA warns mid-band decisions over the next two years will define the performance ceiling for 6G through the 2030s in dense urban markets.

5G differentiation emerges, with Ericsson’s Mobility Report showing operators commercializing guaranteed latency, uplink boosts, and application-aware prioritization — moving beyond “speed-only” plans.

India’s 5G base set to exceed 1B users by 2031, marking one of the fastest 5G scale curves globally, driven by modernization, ARPU repair, and broad device adoption.

FCC advances major upper C-band auctions, setting the stage for a 2027 reallocation that could unlock up to 180 MHz for 5G/6G capacity and reshape satellite incumbency.

Airbus expands mission-critical broadband with Agnet Direct, ensuring secure operations when private or commercial 4G/5G coverage is impaired — validated on France’s RRF.

Jio bundles 18-month Google Gemini Pro access for all 5G users, signaling AI as a core monetization lever for emerging-market operators.

Nokia outlines its AI-native 6G strategy, concentrating R&D on AI-driven RAN, cloud-native core evolution, and next-generation radio systems.

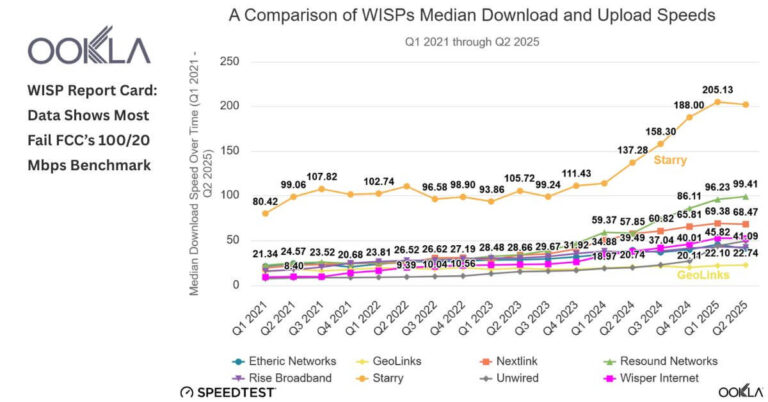

WISPs vs Starlink: performance gap narrows, with U.S. WISPs accelerating speeds even as LEO satellite networks strengthen rural competitiveness.

CTIA Catalyst impact surpasses 30M people, one of the most effective mobile-first public benefit deployments in the U.S.

Orange readies Europe’s first commercial NTN D2D SMS, extending coverage to satellite zones for messaging and location sharing.

AT&T activates 3.45 GHz nationwide, upgrading 23,000 sites with new mid-band spectrum to accelerate 5G FWA and mobile capacity.

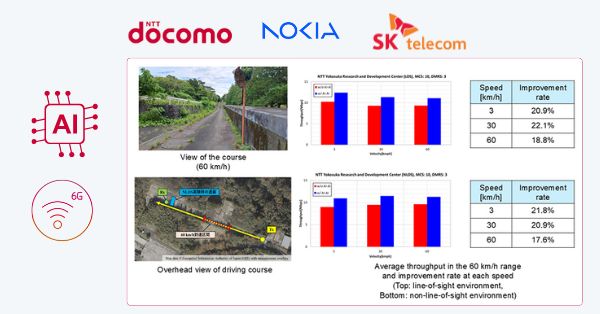

NTT Docomo, Nokia Bell Labs & SK Telecom double 6G throughput with an AI-AI air interface — a real-world outdoor milestone toward AI-native RAN.

Airtel’s credit upgrade reflects ARPU expansion, deleveraging, and sustained 5G subscriber growth in India.

T-Mobile showcases 5G slicing at the Las Vegas Grand Prix, integrating private 5G and edge video into broadcast and public-safety workflows under extreme density.

UK tribunal clears handset overcharging class action, targeting Vodafone, EE, O2, and Three for post-contract device pricing practices.

Jio pushes for flexible 5G net-neutrality rules, emphasizing slicing-enabled QoS for URLLC, industrial automation, cloud gaming, and premium video.

Deutsche Telekom reports strong Q3, with U.S. momentum, FTTH expansion, and raised full-year guidance.

Amazon rebrands Project Kuiper as Amazon Leo, signaling readiness for commercial LEO broadband targeting enterprise and consumer markets.

VC4 highlights “invisible infrastructure” losses, detailing how undocumented fibers, circuits, and legacy assets drain operator revenue and opex.

AST SpaceMobile targets early 2026 nationwide D2D coverage, progressing toward continuous service later in the year with major operator partners.

Spain validates upper 6 GHz (n104) for 5G-Advanced, marking the last major mid-band candidate for 5G/6G capacity expansion.

Ericsson deploys neutral-host 5G at 10 World Trade, setting a scalable model for multi-operator indoor coverage in commercial real estate.

Jio refreshes prepaid plans with AI, OTT, and differentiated 5G bundles — signaling a shift from pure connectivity to value-added service packaging.

Nokia to modernize Denmark’s TNN network, extending its role as sole 5G RAN supplier with AI-driven RAN automation and energy-efficient upgrades.

Nokia & LMT advance tactical 5G for Baltic defense, integrating secure 5G radio with military-grade systems for coalition operations.

Ookla launches Speedtest Pulse Wi-Fi Analyzer, addressing in-building performance issues that drive churn and truck rolls across fiber, FWA, and LEO deployments.

Vodafone & AST SpaceMobile propose a sovereign NTN model for Europe, delivering D2D satellite broadband under national operational frameworks.

BT & Starlink partner on rural ultrafast broadband, offering satellite-powered home connectivity where fixed-line expansion faces terrain and cost barriers.

BT accelerates job cuts as Openreach faces broadband subscriber pressure and increased market competition.

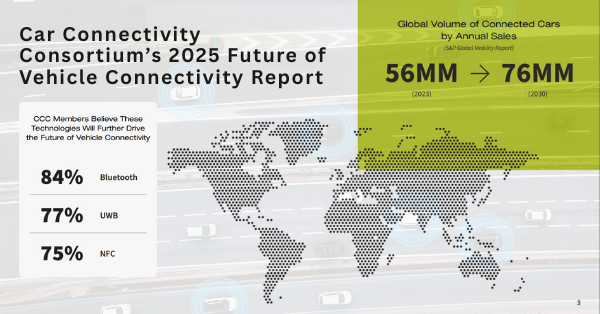

CCC outlines BLE, UWB & NFC standards for connected vehicles, defining the next phase of secure, interoperable vehicle connectivity.

Telecom prices continue falling, posing margin pressure even as operators invest heavily in fiber, 5G, and cloud networks.

Broadband Forum releases 5G FWA for MDUs spec, enabling one outdoor mmWave CPE to deliver gigabit broadband across entire apartments using existing wiring.

OECD data confirms fiber & 5G as global transformation engines, as markets shift from build-out to scaled digital infrastructure.

Dutch telcos launch CAMARA fraud APIs nationwide, aligning with GSMA Open Gateway for network-powered security services.

TELUS Digital takeover strengthens AI CX & 5G monetization, consolidating SaaS and automation capabilities under a single operating model.

FCC moves to rescind CALEA cybersecurity mandate, resetting expectations after high-profile intrusion reports.

Vodafone selects Dell for scaled Open RAN rollouts across Europe, advancing automated, cloud-aligned 5G modernization.

O2 integrates Starlink direct-to-cell for UK rural coverage, launching messaging and low-bandwidth data first.

Related Posts

Artificial Intelligence & Automation

Executive Briefs

AWS commits $50B to U.S. federal AI infrastructure, expanding classified cloud and HPC capacity across AWS Secret and Top Secret regions.

Nokia invests $4B in U.S. AI-ready networks, advancing AI-native RAN, quantum-safe networking, defense applications, and semiconductor innovation.

NVIDIA warns China sales have effectively halted, highlighting the deepening global split in AI supply chains and compute ecosystems.

State-level AI regulation gains traction, with early signals that federal pushback may soften under the new administration.

Enterprises hesitate to hire external AI experts, citing hype and internal misalignment — even as most internal AI projects struggle without specialized talent.

Deutsche Telekom wins SOOFI LLM contract, powering a sovereign 100B-parameter European foundation model for industrial and language-specific use cases.

Verizon restructures toward AI-first operations, cutting 13,000+ roles to simplify workflows and free up capital for automation initiatives.

NVIDIA posts $57B quarterly revenue, with data center growth reaffirming an accelerating global AI infrastructure boom.

Palo Alto Networks acquires Chronosphere for $3.35B, merging observability with AI-driven automation for cloud and AI data centers.

Jio bundles 18 months of Google Gemini Pro, making AI a mainstream 5G monetization layer in the world’s fastest-growing mobile market.

Nokia outlines an AI-native 6G roadmap, focusing on cloud automation, AI-run RAN systems, and capital discipline.

Alibaba.com scales agentic AI for global B2B sourcing, automating supplier discovery, negotiation, and order workflows.

CTIA Catalyst reaches 30M Americans, showcasing AI-powered mobile-first civic and safety outcomes at national scale.

Google commits $40B to Texas AI data centers, prioritizing grid proximity and power availability as the new hyperscale advantage.

Cisco acquires NeuralFabric, signaling enterprise demand for secure, domain-specific small language models deployable across SaaS and hybrid environments.

Jeff Bezos returns as co-CEO of Project Prometheus, a $6.2B venture focused on AI for physical industries and real-world operations.

AI-AI air interface doubles 6G throughput, as NTT Docomo, Nokia Bell Labs, and SK Telecom validate real-world adaptive 6G performance.

AI data centers shift toward 24/7 clean energy, as buyers increasingly demand hourly carbon-free power matching — not just annual RECs.

AI-driven layoffs surge, with October job-cut announcements rising more than 180% month-over-month as enterprises restructure for automation.

Snap integrates Perplexity AI in a $400M partnership, embedding conversational search into the Snapchat interface ahead of a 2026 global rollout.

Telefónica’s 2026–2030 plan centers on AI-enabled savings, targeting €3B in operational efficiencies and accelerated service growth.

LG Uplus & AWS deploy agentic AI for cloud-network ops, delivering up to 80% faster cloud-native software installations.

OpenAI signs a $38B compute deal with AWS, accelerating its multi-cloud strategy and intensifying hyperscaler AI competition.

SK Telecom expands AIDC footprint to 1GW, pushing sovereign AI infrastructure deeper into Korea and Southeast Asia.

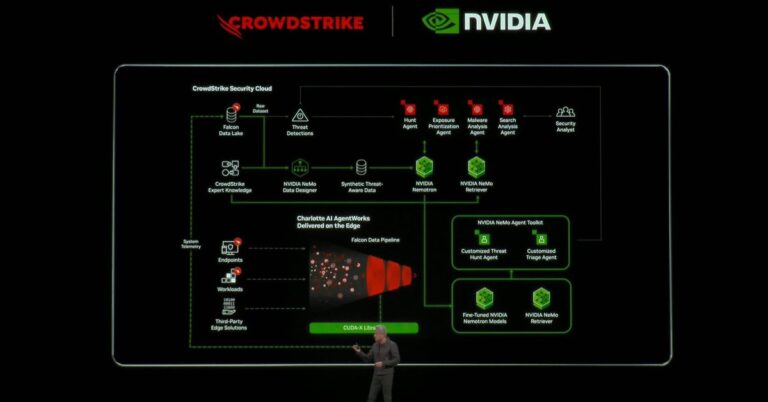

CrowdStrike & NVIDIA launch real-time AI agents at the edge, unifying inference, model design, and autonomous cyber defense.

TELUS consolidates AI CX and SaaS operations, driving monetization and cost optimization across telecom, health, and agriculture verticals.

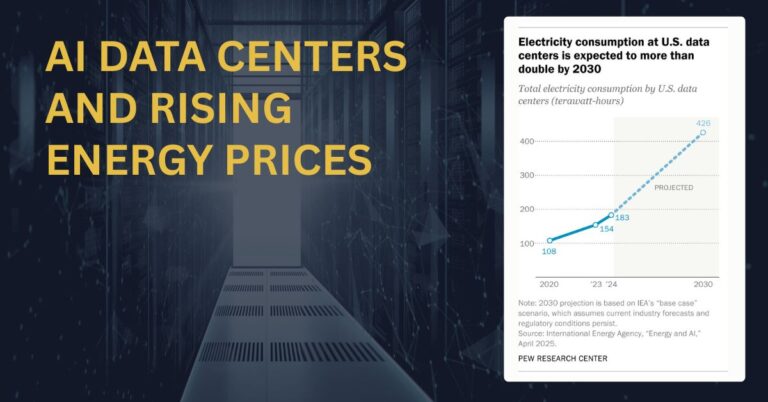

AI energy demand reverses a decade of flat U.S. electricity growth, reshaping grid economics and regional data center site selection.

Vodafone & Dell scale Open RAN automation across Europe, bringing AI-powered 5G modernization into full build-out.

O2 launches Starlink direct-to-cell integration, enabling rural messaging and low-bandwidth data via satellite connectivity.

Hyundai & NVIDIA build a 50,000-GPU “AI Factory” unifying autonomous driving, robotics, and smart manufacturing.

Samsung deploys 50,000+ NVIDIA GPUs, infusing AI into chip design, lithography, robotics, and industrial operations.

Anthropic commits $50B to U.S. AI data centers, positioning domestic compute sovereignty as a long-term priority.

Google unveils TPUs with 4× performance, alongside a multibillion-dollar Anthropic deal — escalating AI accelerator competition.

SoftBank & OpenAI launch SB OAI Japan, delivering localized enterprise AI (“Crystal intelligence”) built for Japanese operations.

Apple nears a $1B deal to power Siri with Google Gemini, marking a landmark shift toward third-party AI integration in consumer devices.

Airtel–Perplexity and Jio–Gemini partnerships reflect a strategic push to convert India’s mobile scale into durable AI adoption and engagement.

The “Green Light Zone” study maps future of work, showing where AI agents align with — or clash against — worker preferences.

HPE forms a Quantum Scaling Alliance, accelerating fault-tolerant, hybrid quantum computing aligned with HPC and semiconductor ecosystems.