The President of the Satellite Industry Association (SIA), Tom Stroup, recently addressed the House Committee on Agriculture, highlighting the pivotal role satellites play in changing the face of farming and ranching in rural America. The SIA represents leading satellite operators, manufacturers, launch service providers, and equipment suppliers, and plays a crucial role in improving the operations of American farms and ranches.

Satellites provide numerous benefits to farmers, including expansive geographical coverage, increased resilience, and rapid deployment, all without the necessity of expensive terrestrial infrastructure. These qualities are instrumental in confronting contemporary challenges in agriculture, such as food insecurity, weather monitoring, and supply chain issues.

The satellite industry’s recent breakthroughs have made high-quality, high-speed broadband and Internet of Things (IoT) connectivity available across the U.S. Satellites are perfectly positioned to assist farmers in meeting these challenges by delivering broadband and IoT services to rural and remote regions where terrestrial services may be uneconomical.

Satellite broadband services, offering speeds up to 200 Mbps, are now directly accessible to consumers in all 50 states. These services are also employed by businesses and government enterprises for both fixed and mobile purposes. Additionally, satellites provide vital backhaul internet connectivity to local ISPs and community institutions in remote areas.

In the field of agriculture, satellites are enabling remote farms with livestock sensors, soil monitors, and autonomous farming equipment. Precision GPS technologies improve crop yields by optimizing the use of fertilizers and pesticides and providing site-specific treatments.

Earth imaging satellites supply high-resolution imagery, assisting farmers in deciding when to plant, water, or fertilize crops. This technology can also offer crop yield estimates, conduct scout monitoring, and keep an eye on global food security. Moreover, satellites are key to advancements in weather forecasting, helping farmers prepare for droughts, floods, and other adverse weather conditions.

Satellites are crucial for 5G and IoT applications that will pave the way for the next generation of farming technologies. This includes enabling remote control of driverless tractors and networked connectivity between large farming equipment.

John Deere CTO Jahmy Hindman predicts that between 50,000 to 100,000 of their machines will be connected to satellites by 2026.

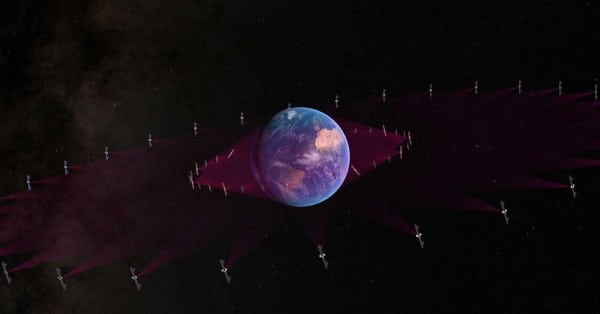

The satellite industry continues to invest and innovate, ensuring it can meet the challenges of the future. Currently, there are nearly 8,000 active satellites on orbit, with plans for tens of thousands more by the end of the decade. Satellite companies are striving to optimize the use of spectrum and minimize costs by investing in high-throughput satellites, software-defined payloads, modular satellites, digital engineering, inter-satellite links, and cloud-integrated ground stations.

Stroup emphasized the importance of utilizing all available access technologies to bridge the digital divide and prevent overbuilding, which could inhibit private investment. He also raised concerns about the high costs and supply chain and labor shortages associated with the USDA ReConnect program’s fiber buildout and the Rural Development Opportunity Fund’s fiber programs.

Stroup also shared several recommendations to advance further broadband and IoT connectivity, which he suggested the Committee should prioritize:

Boosting Satellite Internet Providers: Legislation should contain clauses providing financial incentives or tax breaks to satellite internet providers to stimulate their engagement in rural broadband expansion. Such provisions can invite more companies to invest in satellite infrastructure and services.

Sponsoring Satellite Broadband and IoT Projects: Specific funds or grants should be allocated to aid the development and deployment of satellite broadband and IoT projects, especially those targeting rural and remote areas, including direct support to farms/ranches for last mile connectivity. This could help mitigate the financial obstacles for satellite companies aiming to extend their networks and reach underserved regions.

Adopting Technology-Inclusive Regulations: Laws should use technology-inclusive language and requirements, thus permitting flexibility and inclusivity in broadband and IoT deployment strategies. Legislation that avoids endorsing specific technologies can stimulate competition and innovation among various broadband and IoT providers, including satellite companies. Such an approach can foster the creation of cutting-edge satellite technologies and infrastructure. It can also promote cooperation and partnerships between different broadband and IoT providers, leading to hybrid solutions that utilize the advantages of multiple technologies to provide robust and reliable broadband and IoT connectivity in rural areas.

Simplifying Regulatory Procedures: Interagency collaboration should be implemented to reduce and streamline the regulatory processes for satellite internet providers. The Committee could adopt and implement uniform performance targets that reflect the needs of the agriculture sector, a suggestion supported by the Precision Ag Connectivity Task Force. Further improvements could include reducing bureaucratic obstacles and enhancing the reporting process for programs such as the Rural Utilities Service (RUS), speeding up license approvals, and fostering cooperation among government agencies to facilitate satellite deployment.

Safeguarding Spectrum Availability: Legislation should ensure ample spectrum resources are available for satellite broadband and IoT providers to deliver high-quality, high-speed services. It should advocate for the protection of satellite spectrum and explore possibilities for sharing or repurposing underused spectrum bands.

Promoting Collaboration and Partnerships: The Committee should foster partnerships between satellite companies and other stakeholders, like local communities, educational institutions, and public agencies. Such collaborations can optimize existing infrastructure, share resources, and broaden the scope of satellite broadband and IoT services.

Investing in Research and Development: The Committee should allocate funds for research and development initiatives aimed at improving satellite technology, capacity, and affordability. This can foster innovation within the satellite industry, leading to enhanced performance, reduced costs, and expanded opportunities for rural connectivity. This includes boosting awareness and recruitment efforts in STEM programs.