AI Connectivity Chasm: The New Digital Divide

As AI becomes integral to everything from virtual assistants and image generators to autonomous vehicles and predictive analytics, a stark new divide is emerging in the digital world. This divide—called the AI Connectivity Chasm—is not about who has access to the internet, but who has access to networks powerful enough to support real-time AI applications.

AI workloads—especially those requiring instant decision-making or real-time collaboration—place far more demand on network infrastructure than traditional entertainment services. Where streaming a movie once defined broadband quality, now it’s about whether your network can support a live AI-generated video, handle low-latency collaboration between remote teams, or quickly analyze large data sets on demand. For both individuals and businesses, connectivity has become the single biggest enabler—or limiter—of AI innovation.

The Network Is the Experience

In this new environment, the network itself becomes the product. Users don’t care whether a delay in their AI-generated image or malfunctioning assistant is caused by the application or the underlying network. In practice, they blame the internet or the mobile provider. That means the quality of a network now directly impacts customer satisfaction, loyalty, and brand perception.

This shift marks a fundamental redefinition of broadband. Connectivity is no longer a utility—it’s an essential productivity and creativity platform.

Why Legacy Networks Are Holding AI Back

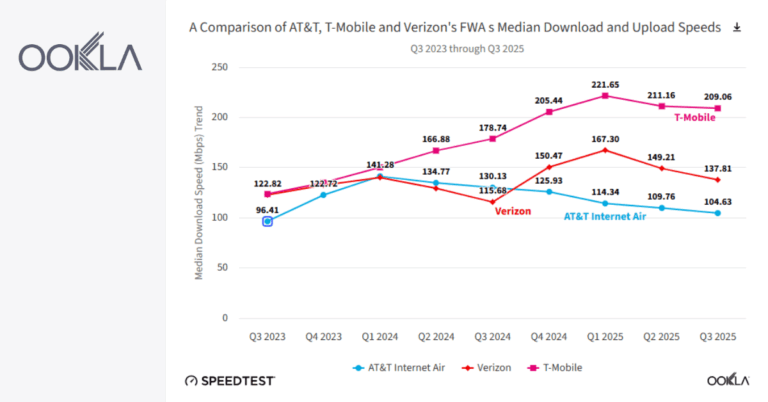

Older technologies like DSL and traditional satellite internet struggle with both bandwidth and latency. They are unable to support modern AI tasks such as real-time collaboration, interactive content generation, or large-scale cloud model inference. Even many current Fixed Wireless Access (FWA) implementations can hit a ceiling when users attempt AI tasks that require symmetrical upload and download speeds.

This infrastructure gap limits the rollout of AI services in rural and suburban areas, where outdated network technology is still common. It also suppresses demand. Many users in underserved areas try an AI tool once, find it slow or unresponsive, and give up. Not because the application is poorly built, but because their connection can’t support it.

Fiber and 5G: Infrastructure for the AI Economy

The gold standard for AI-capable infrastructure is fiber. Its high capacity, symmetrical speeds, and extremely low latency create a frictionless environment for bandwidth-heavy AI use cases like real-time video generation or large file processing.

Equally critical is the role of 5G, particularly for mobile AI experiences. With its ultra-low latency and fast throughput, 5G can power responsive applications like augmented reality-based shopping, instant visual search, or natural language translation—right from a user’s smartphone. 5G also acts as a bridge in areas where fiber isn’t yet deployed, offering meaningful performance boosts over legacy networks.

Together, fiber and 5G define the infrastructure stack required to support AI-native services in both consumer and enterprise contexts.

The Rise of AI-Centric User Segmentation

Network performance is already shaping how users interact with AI. Those on high-quality fiber or high-bandwidth cable connections tend to engage in more advanced, creative AI activities: generating videos, editing high-resolution content, or training local models. In contrast, users on slower or high-latency connections are often limited to basic AI tasks like grammar correction or web search.

This creates two distinct user groups:

-

High-Bandwidth AI Creators: Individuals or businesses who rely on fast, reliable connectivity to create content, collaborate remotely, or build applications powered by AI.

-

Low-Bandwidth AI Consumers: Users who engage with AI at a basic level due to infrastructure limitations.

This segmentation is a powerful tool for telecom and broadband providers. It allows for more precise product bundling, tiered service offerings, and targeted marketing. Providers who understand this divide can tailor their services to meet the real-world needs of high-value AI users—and upsell them on premium plans.

FWA as a Tactical Tool, Not a Long-Term Solution

In regions where fiber rollouts are still years away, FWA provides a viable interim solution. It can deliver 100+ Mbps speeds sufficient for most mid-weight AI applications, such as document analysis or simple video editing.

For telcos, FWA serves as a customer acquisition tool in areas dominated by DSL or underperforming cable. Performance-focused users in these areas—especially small businesses, creators, and remote workers—are eager to upgrade. These users aren’t particularly price-sensitive. They are performance-desperate. If a provider can promise low-latency, AI-ready internet, they’ll switch.

However, FWA has limitations. Long-term, as AI demands increase, FWA may not be sufficient for high-end use cases. Providers must recognize FWA’s role as a bridge—not the destination.

Beyond Speeds: AI-Driven Network Intelligence

While raw speed and low latency are crucial, the ability to dynamically manage and optimize a network is becoming equally important. This is where AI in networks plays a transformative role.

AI enables:

-

Dynamic resource allocation to adjust capacity based on real-time demand.

-

Self-healing capabilities that detect and fix faults without human intervention.

-

Predictive maintenance that alerts engineers before performance degrades.

-

Energy efficiency through intelligent traffic routing and load balancing.

These advancements help telecom providers reduce operational costs while improving customer experience. They also make the network more resilient—an increasingly important factor as AI becomes central to daily life and work.

Mobile AI: The Everyday Gateway

Most daily AI interactions now happen on mobile devices. From visual search and voice assistants to AR-based applications and generative content creation, smartphones are becoming AI engines in users’ pockets.

This makes mobile network performance more critical than ever. A dropped connection or laggy AI tool isn’t just an inconvenience—it’s a brand liability. Users will associate the failure with the provider, not the application.

Mobile users expect instant responsiveness from their apps. Only 5G networks can consistently deliver the performance needed to meet this expectation. Providers that lead in 5G coverage and quality have a powerful advantage in capturing and retaining these AI-driven mobile users.

The Economic Stakes Are High

This transformation in connectivity is reshaping the economics of the telecom and cable industries. Providers that build and market AI-capable infrastructure are poised to capture a high-ARPU (Average Revenue Per User) segment that values performance over price.

These customers:

-

Have lower churn rates.

-

Are more likely to upgrade to premium plans.

-

Engage in higher levels of data usage.

-

Depend on network performance for productivity and income.

The cost of not competing in this space is steep. Providers who fail to meet the connectivity needs of AI-driven users risk being relegated to the low-margin segment of the market—serving basic connectivity to customers who aren’t willing or able to pay for more.

Strategic Actions for Providers

To succeed in this AI-driven environment, providers need to align their infrastructure and product strategies around the following imperatives:

1. Accelerate Fiber Deployment

Fiber is the foundational infrastructure for AI productivity. Providers should continue to aggressively build out fiber networks, especially in urban and high-density suburban areas where demand is concentrated.

2. Expand and Enhance 5G Coverage

Mobile AI is now ubiquitous. Telcos must invest in 5G buildouts, especially in metro areas where mobile AI usage is highest. Advanced 5G capabilities like network slicing and edge computing will be critical to support real-time services and differentiated experiences.

3. Use FWA to Capture Rural Market Share

In markets where fiber deployment isn’t yet viable, high-performance FWA provides a path to capture rural AI users. Targeted campaigns should highlight performance, not price—emphasizing AI enablement, responsiveness, and productivity.

4. Build and Market AI-Optimized Plans

Providers should stop selling bandwidth and start selling outcomes. Market offerings based on AI readiness, not just download speeds. Create bundled packages optimized for AI creators, including both fixed and mobile connectivity.

5. Invest in AI-Driven Network Automation

To stay competitive, providers must also transform internally. AI should be used to streamline operations, reduce costs, and deliver predictive and proactive service improvements. From dynamic traffic management to automated customer support, intelligent networks will become a core competitive asset.

The Future: Networks as AI Enablers

The AI connectivity chasm is not theoretical—it’s already influencing user behavior, buying decisions, and provider market share. Those who bridge this gap with infrastructure investments, intelligent operations, and AI-centric service design will lead the next phase of telecom growth.

Connectivity is no longer just about getting online. It’s about enabling what users do once they are there. In a world defined by AI, the network is the foundation of value creation. Providers that understand and act on this insight will win the future. Those that don’t will be left behind.