- Tech News & Insight

- November 6, 2025

- Hema Kadia

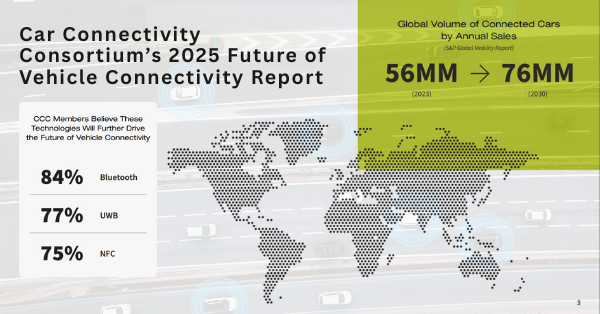

New data from the Car Connectivity Consortium’s 2025 Future of Vehicle Connectivity Report signals how OEMs, suppliers, and mobile platforms will prioritize standards, security, and interoperability to scale the next phase of software-defined vehicles. The market is past pilots: executives are moving budget into customer experience and fleet productivity where