- Tech News & Insight

- December 16, 2025

- Hema Kadia

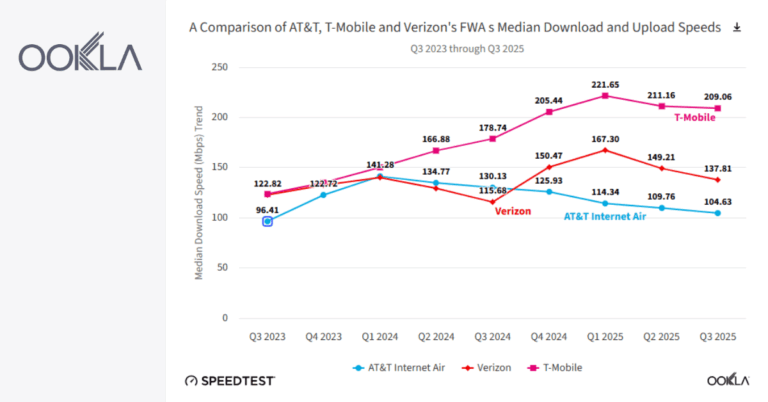

A new analysis of U.S. fixed wireless access shows subscriber momentum outpacing performance, a signal that capacity and management strategies are under pressure. Fixed wireless access from T-Mobile, Verizon, and AT&T added about 1.04 million net customers in Q3 2025, taking the U.S. FWA base to roughly 14.7 million. T-Mobile