- Tech News & Insight

- December 9, 2025

- Hema Kadia

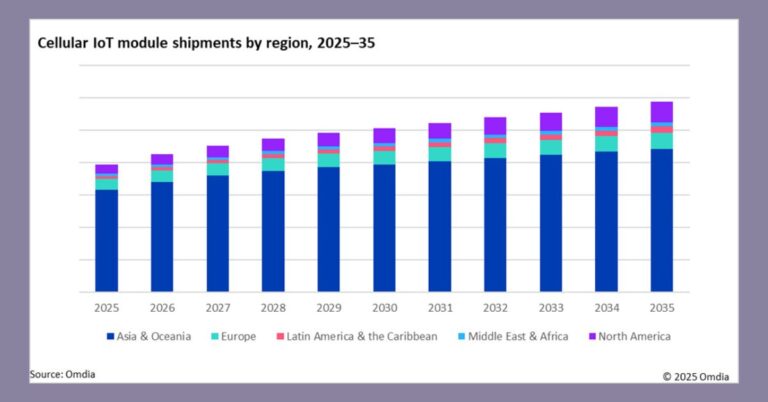

New data points to a step-change in cellular IoT adoption as 5G broadens into mid-tier and massive-scale use cases while 4G-era LPWA keeps expanding. Omdia forecasts cellular IoT connections to reach roughly 5.9 billion by 2035, driven by expanding addressable use cases across industrial automation, utilities, transportation, retail, and consumer-adjacent