- Tech News & Insight

- November 24, 2025

- Hema Kadia

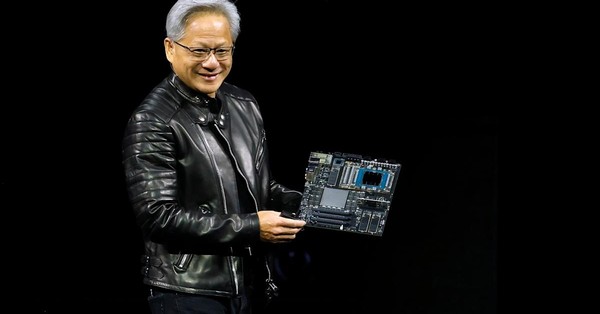

Nvidia’s CEO has warned that U.S. export controls have effectively halted the company’s China business, sharpening the stakes for AI leadership, supply chains, and enterprise buyers. He indicated the company is modeling China sales at effectively zero for the next two quarters under current rules, acknowledging that the revenue loss