AI in Telecom: Nvidia’s Report Highlights Growth, Challenges, and Future Trends

Artificial intelligence is rapidly transforming the telecommunications industry. Nvidia’s latest State of AI in Telecommunications report reveals that telcos are increasing their AI investments, seeing measurable returns, and preparing for a future where AI plays a central role in network infrastructure and business operations.

Telecom AI Adoption Hits 97%: A Strategic Priority for Telcos

The telecom industry has fully embraced AI, with 97% of telcos either assessing or adopting AI in their operations. This represents a sharp increase from previous years, signaling that AI is now a key strategic priority for network operators, system integrators, and service providers.

- 49% of telcos are actively using AI, up from 41% in 2023.

- 65% plan to increase AI infrastructure spending in 2025, prioritizing network automation, customer service improvements, and business intelligence.

- AI investments are focused on revenue growth, cost reduction, and improved customer experiences.

AI’s Growing Impact on Revenue and Cost Savings

Telcos are not just experimenting with AI—they are seeing real financial benefits. According to the report:

- 83% of telcos confirmed that AI has increased their annual revenue.

- 77% said AI helped reduce operational costs.

- 21% reported a revenue increase of more than 10% due to AI adoption.

With the telecommunications sector facing slow revenue growth from 5G deployments, AI is emerging as a critical tool for boosting profitability.

Top AI Use Cases in Telecommunications

AI is making an impact across various areas of telecom operations. The most common use cases include:

- Employee efficiency (58%) – AI-powered automation tools are streamlining tasks and boosting productivity.

- Customer service optimization (44%) – AI chatbots, virtual assistants, and automated support solutions are improving customer experiences.

- Network operations and planning (37%) – AI is being integrated into RAN infrastructure to enhance efficiency and optimize resource allocation.

- Field operations optimization (33%) – AI-driven tools are improving network maintenance and reducing downtime.

- Security enhancements (33%) – AI is helping telcos strengthen network security and detect cyber threats in real time.

These trends indicate that AI is moving beyond experimental projects and becoming an essential part of telecom operations.

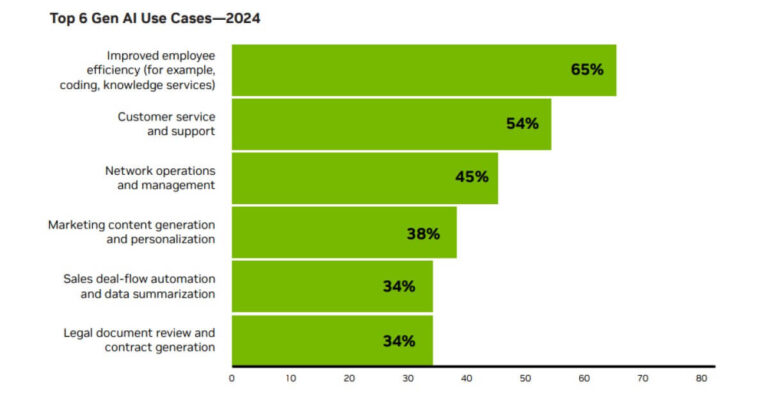

Generative AI in Telecom: Expanding Use Cases and Revenue Potential

Generative AI is gaining momentum in the telecom industry, with 49% of telcos already using or assessing generative AI solutions. The most popular applications include:

- Employee efficiency tools (65%) – AI-powered assistants for coding, knowledge management, and content generation.

- Customer service automation (54%) – AI chatbots and virtual agents are reducing customer wait times and improving issue resolution.

- Network operations (45%) – AI is optimizing network management, fault detection, and predictive maintenance.

- Marketing content personalization (38%) – AI is enabling automated content creation and targeted advertising.

- Sales automation (34%) – AI is streamlining deal flow, data summarization, and contract generation.

Additionally, 84% of telcos plan to offer generative AI solutions to their customers, with 52% aiming to provide AI-powered software-as-a-service (SaaS) solutions. This presents a major opportunity for telcos to create new revenue streams beyond connectivity services.

Sovereign AI: A Strategic Advantage for Telcos

Sovereign AI is a growing area of interest for telcos, referring to a nation’s ability to develop AI using its own infrastructure, workforce, and data. Nvidia highlights that telcos are in a unique position to support sovereign AI initiatives due to their:

- Existing infrastructure – Telcos operate data centers and network infrastructure that can be leveraged for AI workloads.

- Government relationships – Many telcos have strong partnerships with national governments, making them ideal partners for sovereign AI projects.

- Expertise in large-scale deployments – Telcos have experience managing nationwide infrastructure, giving them an edge in AI-driven projects.

By investing in sovereign AI, telcos can expand their role beyond connectivity providers and become key players in national AI strategies.

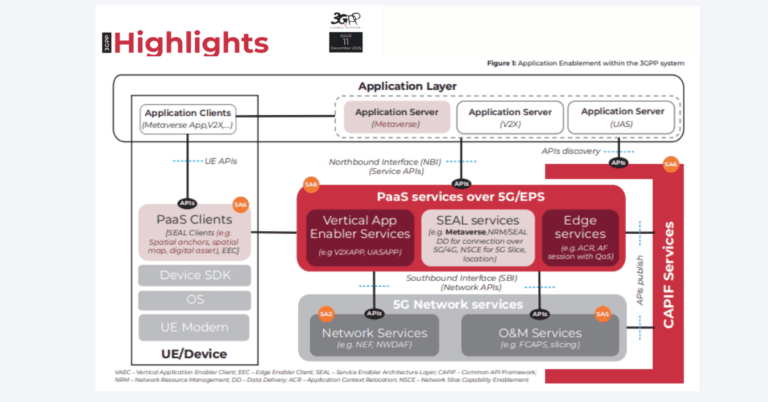

AI-RAN: Integrating AI Into Network Infrastructure

One of the biggest shifts in telecom AI adoption is the integration of AI into Radio Access Network (RAN) infrastructure. The report found that:

- 66% of telcos are deploying AI services on the RAN to optimize network performance.

- 53% are using AI to enhance spectral efficiency.

- 50% are colocating AI and RAN applications on the same infrastructure.

This trend, known as AI-RAN, enables telcos to process AI workloads alongside traditional network functions. By leveraging AI-RAN, operators can maximize infrastructure utilization, reduce costs, and improve service delivery.

Overcoming AI Adoption Challenges

While AI adoption is growing, telcos still face key challenges in scaling AI initiatives. The top barriers include:

- Lack of AI expertise (43%) – The need for AI-skilled professionals, such as data scientists and engineers, is a major roadblock.

- Difficulty quantifying ROI (38%) – Many telcos struggle to measure the financial impact of AI investments.

- Budget constraints (30%) – AI infrastructure and development costs remain a challenge.

To address these issues, 43% of telcos are engaging third-party partners to co-develop AI solutions, and 40% are using open-source AI tools.

AI Investment Priorities for 2025

As AI adoption matures, telcos are prioritizing investment in key areas to scale AI at an enterprise level. The top spending priorities include:

- Partnering with third-party AI providers (43%) – Telcos are collaborating with independent software vendors, system integrators, and AI specialists.

- AI training for employees (40%) – Upskilling staff to improve AI literacy and implementation capabilities.

- Expanding AI infrastructure (35%) – Investing in AI-ready cloud and edge computing resources.

These investments will help telcos overcome existing challenges and accelerate AI-driven transformation.

AI and 6G: The Future of Telecom Networks

Looking ahead, AI will play a crucial role in shaping the next generation of telecom networks. As telcos begin research and development on 6G, AI will be deeply integrated into network design, automation, and service delivery.

The report highlights that AI-native networks will replace traditional software-defined networks, enabling:

- Real-time network optimization – AI will dynamically adjust network parameters based on usage patterns and performance needs.

- Energy efficiency improvements – AI will help reduce power consumption and optimize resource allocation.

- Advanced AI-driven applications – 6G networks will leverage AI for ultra-low-latency applications, immersive experiences, and edge computing innovations.

As AI becomes a foundational element of 6G, telcos will need to invest in AI capabilities to remain competitive in the next era of connectivity.

AI’s Role in Telecom: Key Takeaways from Nvidia’s Report

Nvidia’s State of AI in Telecommunications report confirms that AI adoption is at an all-time high, with telcos seeing measurable benefits in revenue growth, cost savings, and operational efficiency.

Key takeaways:

- 97% of telcos are engaged with AI, and 65% plan to increase AI spending in 2025.

- AI is boosting revenue and reducing costs, with 21% of telcos seeing a 10%+ revenue increase.

- AI use cases are expanding, from employee productivity and customer service to AI-RAN and sovereign AI.

- Generative AI adoption is accelerating, with 84% of telcos planning to offer AI-powered services.

- AI will be central to 6G networks, driving automation, energy efficiency, and new revenue models.

As AI continues to evolve, telecom operators must strategically invest in AI infrastructure, workforce development, and partnerships to maximize its potential. The coming years will be transformative, as AI becomes deeply embedded into every aspect of telecom networks and services.